By Peter Squire

A slowing MLS® sales trend took root in October 2022 with sales down from October 2021.

Beyond the well-documented boom in MLS® sales activity that took place in 2020 and 2021 with buyers advancing their plans to take advantage of historic low interest rates and make moves induced by a pandemic which ignited many Canadians to change their living arrangements, 2022 October sales were impacted by cost of living concerns combined with a rapid rising interest rate environment which saw the Bank of Canada increase its overnight lending rate from 0.25% in March to 3.75% in October 2022.

To reference MLS® activity in the past 2 years, October MLS® sales of 1,063 decreased 30% from October 2021 and 33% from the record-setting October in 2020. Before the onset of the pandemic in 2020, the 5-year average for October was 1,105 sales indicating sales this same month were consistent with pre-pandemic Octobers.

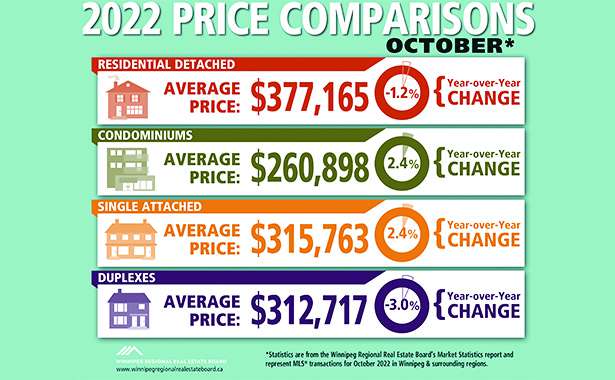

In October 2022, the average single-family home sales price is right where we started the year at $377,000 with sales going for above list price reversed with less than one out of five sellers receiving more than list price and 76% below list price.

Looking more specifically at the 5 MLS® zones across Winnipeg and our larger regional market area outside the city, the average single-family home sale prices are more affordable with the three north Winnipeg zones well under the $377,000 market region average at $302,007, $311,747, and $325,998 respectively. The regional area outside Winnipeg is at $360,189 while southeast and southwest Winnipeg have come down as well to $464,160 and $497,195. In April, the southwest area average sales price reached its highest level at $587,865.

“Moving into balanced market territory is a positive development,” said Akash Bedi, 2022 president of the Winnipeg Regional Real Estate Board. “This should be particularly beneficial to first-time home buyers who were unable to compete in the multiple offer frenzy and now have time to weigh their options and negotiate a better price.”

Backing up this point is the release of the latest monthly MLS® Home Price Index (HPI) numbers for Winnipeg by the Canadian Real Estate Association (CREA). The HPI is the best gauge of home price trends in Canada as it follows a home with similar attributes over time and is much closer to an apples-to-apples comparison than an average sales price which is affected by compositional shifts where sales activity can be more active in certain price ranges than others and can skew the monthly sales price up or down.

The October 2022 HPI shows Winnipeg’s benchmark price for a single-family home is $337,400, only down $2,500 from September.

Single-family home activity was most active under $400,000 with 50% of sales occurring under $350,000 and another 13% from $350,000 to $399,999. The highest sale price was $1,550,000 and the lowest was $19,900.

“I think you would be hard-pressed to find any major city in the country where they have half of their single-family home sales in October 2022 are selling for under $350,000, “said Bedi. “It is worth noting that our market region condominiums are much more affordable with 70% of sales in October 2022 selling under $300,000.”

As indicated last month and much the same now, condominium prices have not experienced the big spike in prices single-family did this year nor have they fallen back either. In October, the most active condo price range was the $150,000 to $199,999 at 23% of sales while another 18% took place in the next higher price range from $200,000 to $249,999. The highest sale price was $680,000.

A metric which single-family usually outperforms condominiums on is what is referred to as continuous days on market before a property sells on the MLS®. Even in September continuous days on market for single family homes sales was 26 days when it was 33 days for condominiums. This month condos were quicker to sell with an average of 29 days compared to 31 days for single family.

“I always stress we need to be providing buyers with different housing options for them to consider so to see condominiums turning over faster this month is indication buyers are open to other choices,” said Bedi.

“REALTORS® work with a network of other professionals like lawyers, mortgage brokers and appraisers to make sure buyers and sellers are well informed on what they need to know to conclude a successful transaction,” said Marina R. James, CEO of the Winnipeg Regional Real Estate Board.

Peter Squire is the Winnipeg Regional Real Estate Board’s Vice-President External Relations & Market Intelligence.