By Trevor Clay

The Winnipeg commercial real estate market is known as a very stable one which is able to avoid booms and busts that impact others, however, even our market cannot avoid the impact of COVID-19. That said, its impact has not been consistently negative.

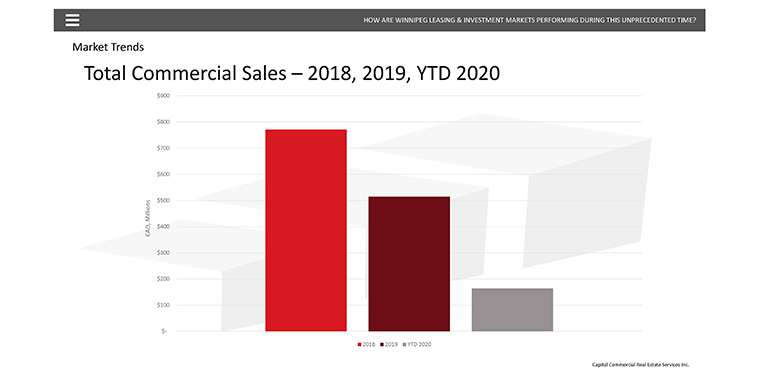

Just as they are across the country, commercial sales in Winnipeg are down significantly in 2020. As of the end of October, we have seen less than $200 million and are on track for overall sales under $250 million. We expect that there will be a slight recovery in the 4th quarter but will still not get anywhere close to 2019 levels of $500 million.

Most of the sales activity in the market in 2020 has been in multi-family due to the extremely attractive interest rates in this asset class and the perceived low levels of risk. We hope to see overall sales activity recover to 2019 levels in 2021 due to pent up demand and low interest rates.

The office market has yet to see the long-term impact of the pandemic. While the majority of office tenants continue to work remotely, we have yet to see a significant negative impact on office vacancy with overall market vacancy sitting at 11.6%. While asking rents continue to rise slowly, landlords are having to invest more money to complete new leasing transactions. Most tenants are looking to secure short-term lease renewals while they determine their long-term office requirements. The suburban office market continues to perform well.

The industrial market has continued to perform extremely well with overall market vacancy dipping back below 5% and net rents continuing to inch closer to $10.00 per square foot net, currently sitting at $9.26 per square foot per annum. In the third quarter of 2020, we saw approximately 600,000 square feet of positive absorption in the market. This is primarily due to large scale industrial lease transactions including FedEx Ground moving into its new 250,000 square foot distribution centre in St. Boniface Industrial Park, Amazon leasing 113,000 square feet at 11 Plymouth Street and QuadReal completing the lease up of its first 175,000 square foot speculative building at Northwest Business Park.

We expect a total of over 1 million square feet of new industrial product being delivered to the market in 2020, the majority of which is in Northwest Winnipeg, putting greater pressure on vacancy in that quadrant. In addition, there is an additional 900+ acres of land which various developers are now either developing or bringing to market.

Retail has felt the direct impact of COVID-19. We have seen significant national store closure announcements as well as tenants applying for Canada Emergency Commercial Rent Assistance (CECRA). Vacancy in the retail market has not yet increased to reflect the impact on the market, however we expect this to show in the market in 2021 as hospitality tenants will continue to feel the direct impact of intermittent shutdowns. The majority of new tenant growth has been in the grocery and service sectors.

Multi-family in Winnipeg has been the only asset class in Winnipeg that has continued to experience consistent volumes of successful investment sales transactions through the pandemic. With interest rates at historically low levels and demand remaining high, we expect this trend to continue.

Private capital demand for commercial real estate investment opportunities remains incredibly high in Winnipeg, although increased scrutiny on the office and segments of the retail asset class will impact values on specific assets in these sectors.

Trevor is a principal at Capital Commercial Real Estate Services Inc. and a former commercial division chair at WinnipegREALTORS®.