by Carla Staresina

Real estate professionals were rated as the most valuable interaction during the home buying process, according to a recent survey. In April 2018, Canada Mortgage and Housing Corporation (CMHC) surveyed 4,000 active mortgage consumers, of which 16% were home buyers, as part of its annual Mortgage Consumer Survey (MCS).

The MCS is the largest survey of its kind in Canada and has been conducted since 1999. It provides insight into the behaviours, attitudes and expectations of Canadians when they take out, renew or refinance a mortgage.

According to the survey, 24% of first-time buyers and 34% of repeat buyers indicated the most valuable interaction during the home buying decision process came from real estate professionals. Here are the other key findings REALTORS® need to know:

• Fifty-eight percent of first-time buyers rent for up to five years before purchasing their first home. When asked if they believed homeownership was a good long term investment, 74% of first-time buyers and 89% of repeat buyers agreed with the statement.

• The main factor considered by all home buyers when buying a home is price and affordability. Other factors considered when buying a home were type of neighbourhood and type of home.

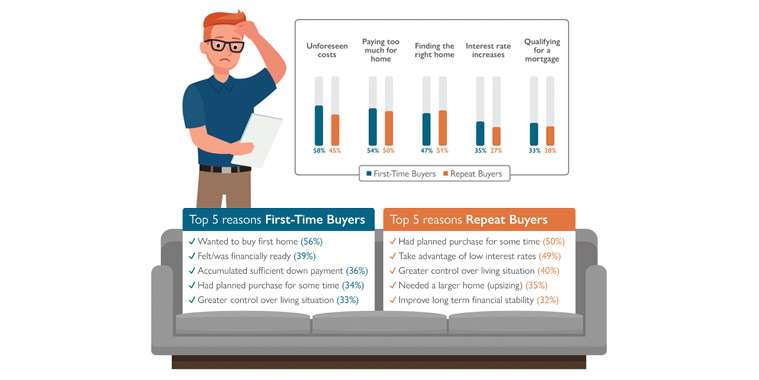

• Forty-two percent of first-time buyers and 31% of repeat buyers felt concerns or uncertainty about buying a home. Of those with concerns, the main ones were unforeseen costs, paying too much for their home and finding the right home. Twenty-eight percent of first-time buyers and 22% of repeat buyers incurred unexpected costs. Nineteen percent of home buyers were involved in a bidding war.

• When it comes to gathering mortgage-related

information, 19% of first-time buyers and 20% of

repeat buyers use the website of a real estate agent or agency. Facebook is the top social media channel used among home buyers followed by YouTube.

The top information needs for home buyers were:

• Interest rates

• Mortgage or house purchase fees

• Steps involved in buying a house

• Closing costs

• Tools to manage their mortgage

• How to face financial difficulties