By Peter Squire

More indication of condominium sales activity being the default position for an alternative affordable option to the more expensive single-family home was readily apparent in the third quarter.

Where condominium sales in July, August and September totaled 644 sales and were able to eke out a slim edge over 2020 for the same three months, single-family homes or residential-detached properties with 3,345 sales experienced a decrease of 15% compared to the same period in 2020.

As has happened in other major markets across the country — where single family homes have become out of reach for first-time buyers in particular — condominiums have always been a good choice to consider to get a foothold in the ownership market instead of continuing to rent.

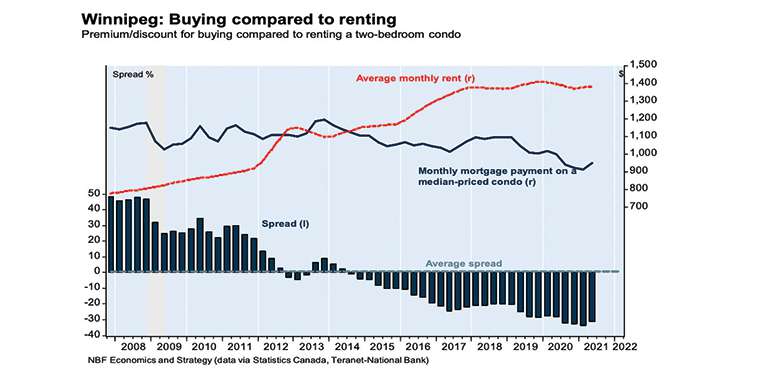

In fact, the most recent National Bank Housing Affordability Monitor for second quarter 2021 — where real concerns were expressed about the deterioration in national housing affordability — shows, in Winnipeg’s case, the clear advantage or premium for owning a two-bedroom condo over renting. The monthly payment for a median priced condo was $949 versus $1,379 for renting an apartment. It also notes that at a savings rate of 10% per year you can come up with the necessary down payment in 18 months. In Hamilton, it will take you 46 months, and even Montreal is now at 31 months.

Affordable prices certainly have a lot to do with opting to buy a condo in many housing markets including the Winnipeg Regional Real Estate Board’s regional market. After just completing the third quarter, results show the single-family average home sales price in the third quarter was $374,777 while the average sales price of a condominium was $131,000 less at $243,734.

More evidence in this regard comes from where price range sales activity is happening within these two primary MLS® property types. In September, over three out of four — or 76.8% of condo sales — occurred from $100,000 to $299,999. The most active price range by far was from $150,000 to $199,999 at 31.4%.

In sharp contrast, 75% of single-family home sales were more spread out and took place from $200,000 to $550,000. Nearly half or 36% of sales were from $275,000 to $399,999.

Listing availability is another factor to consider when seeing how condos are holding their own with brisk third quarter sales activity in 2020 compared to single-family. Several MLS® areas throughout Winnipeg have been hard pressed to keep up with single-family home purchase demand. At month end, available or active listings are considerably depleted which creates real challenges, especially for first-time buyers, with multiple offer situations on what remains or comes onto the market the following month.

At the end of September, there are neighbourhoods with listings in the single digits for sale, and as a result, have very high sales-to-active listings. A few examples here will show the extent of sellers’ market conditions for single-family homes. Whyte Ridge has a ratio of 1200% and had 12 sales in September with only one listing remaining for sale in October. River Park South has a ratio of 767% based on 23 sales and only 3 listings available for sale, while East Kildonan has a ratio of 400% with 12 sales and just three listings going into October.

Condominiums, on the other hand, are in much better shape with sales-to-active-listings ratios well under 100% in many MLS® areas. Osborne Village has 72 active listings compared to 9 sales in September, and Linden Woods has 20 listings versus 10 sales, so a 50% sales-to- active-listings ratio. River Park South is one of the few exceptions where it has 136% sales-to-active-listings ratio with 15 sales in September and 11 listings left to sell.

The overall sales-to-active-listings ratio in September for single-family was 78% compared to 38% for condominiums. Despite this big difference, condominiums are performing exceptionally well with 66% of all listings entered on the MLS® from January 1 to September 30 selling this year. The previous 5-year average sales-to-listing conversion rate for condos was 44% with the best year at 46%.

As a result of a much higher conversion rate this year, and a similar number of condo listings entered on the MLS® compared to the previous 5-year average (i.e. 3,037 versus 3,109), sales have already set a new all-time annual record of 2,014. The previous record was recorded last year with 1,847. Year-to-date condo sales are up 49% compared to the same period last year.

Single-family sales are doing well, too, but the percentage increase over 2020 is much more constrained at 15%.

With another 3 months to go before year-end, it is clear that condominium sales are positioned well to add many more sales to their current total. For the first 12 days in October the trend of condo sales in 2021 outperforming the same period last year continues. There have been 93 sales compared to 71 in 2020. This brings the annual total over 2,100.

Based on strong demand and record sales activity for condos in 2021, there will be a modest improvement in the average sales price over 2020. The average year-to-date condo sales price at the end of September is $244,171 whereas for the same period in 2020 it was $240,499.

On a final note, the Canadian Real Estate Association’s MLS® Home Price Index, which tracks sales of the most typical apartment condo every month in regional markets like Winnipeg’s, shows at the end of September the benchmark price is $206,300. It was $196,300 at the end of 2020 and has been as high as $209,700 in July 2021. So on a positive note, condo prices are increasing but still remain very affordable for buyers in our local market.

Peter Squire is the Winnipeg Regional Real Estate Board’s Vice-President, External Relations & Market

Intelligence.