By Peter Squire

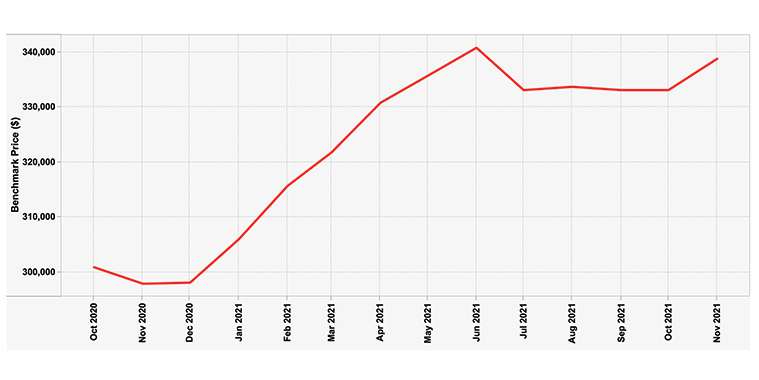

As the year winds down, let’s take a cross-Canada tour on MLS® HPI- an index developed by the Canadian Real Estate Association (CREA) in partnership with Altus Group to offer Canadians the most advanced and accurate tool to gauge home price levels and trends. The MLS® HPI is based on the value home buyers assign to various housing attributes, which evolve gradually over time.

Each month, the MLS® HPI uses more than 15 years of MLS® System data and sophisticated statistical models to define a “typical” home based on the features of homes that have been bought and sold. These benchmark homes are tracked across Canadian neighbourhoods and different types of houses. REALTORS® have direct access to all of the more detailed neighbourhood breakdowns as

defined by local real estate boards through the MLS® areas they have created and track every month.

Let’s start on the west coast and move east to capture some of the most mentioned housing markets in the country. Winnipeg was noted in the November market release and will be highlighted again here. It will become abundantly clear while reviewing some of these benchmark prices — attributed to the most typical single-family home in these markets — that prices vary considerably, as do the increases we have experienced in 2021.

All prices and increases are based on looking at the benchmark prices at the end of 2020 and then examined again after the first 11 months of 2021 by checking the index at December 1, 2021. They are not seasonally adjusted.

Victoria’s single-family home benchmark price increased 25% and was enough this year to top out over $1 million to $1,040,700 at the end of November 2021. It was $883,800 in December 2020. Greater Vancouver started the year at $1,575,000 and is at $1,878,000 presently, a 19% rise its benchmark price.

The three other western provinces are far more affordable in comparison to B.C. Starting with Alberta, Edmonton saw its single-family home benchmark price go from $379,300 to $398,200, a modest 5% increase. Calgary’s benchmark percentage increase was higher at close to 11% as it rose from $454,300 to $502,400. Saskatoon’s benchmark price is up 6% to $358,600, while Regina’s has risen the same percentage to $268,600.

In the centre of Canada, Winnipeg shows close to a 14% jump in its benchmark price from $297,700 to $338,800. It is worth noting that the HPI index tracks both one-storey and two-storey homes. Inevitably, the latter are always higher priced. In November, Winnipeg’s one-storey was $326,200 and the two-storey was around $30,000 more at $356,700.

Ontario takes house prices to a much higher level, much like what we are seeing in B.C. Let’s look at Hamilton-Burlington first since this city is fresh in everyone’s mind after hosting a glorious Grey Cup game (with the Winnipeg Blue Bombers prevailing in overtime against the Hamilton Tiger-Cats in a very hard-fought battle to give them two consecutive Grey Cup victories).

Hamilton-Burlington has joined the $1 million-dollar benchmark price club this year and has seen its price go from $807,200 to $1,035,600. This represents a 28% increase and is not uncommon in a number of Ontario housing markets this year. Kitchener-Waterloo, for example, has catapulted 29% to rise more than $200,000 to $915,800.

Our capital city Ottawa has risen as well, with a 15% upward trajectory to $735,000.

We cannot talk about Canada’s housing markets without citing Toronto. Greater Toronto (as it is referred to in CREA’s MLS® HPI) started at $1,063,800 and is now at $1,386,900 — a gain of over $300,000 and a percentage increase of 30%.

In Quebec, Quebec City is remarkably close to Winnipeg at the beginning and end of the 11-month period in 2021. Its present benchmark price is just below Winnipeg’s at $334,700 while starting off a few thousand dollars less at $295,200. Not surprisingly, the percentage increase is almost identical at 13%.

Montreal at one time — going back a number of years — was much more aligned with Winnipeg and Quebec City in its house price level, but that’s no longer the case. 2021 exemplifies its considerably more elevated status with a 22% rise to $578,800.

CREA’s MLS® HPI has yet to capture the Halifax-Dartmouth market, but from looking at recent housing reports, they indicate rapid price increases this year in the 25% range and average single-family homes in the high $400s to close to half a million dollars.

St. John’s Newfoundland’s HPI at the end of November 2021 is $294,300 — a 9% increase.

The aggregate benchmark single-family home price for Canada — based on all the markets CREA’S MLS® HPI encompasses — is $858,100, up 25.7% from $682,500 in December 2020. These numbers clearly reveal how all markets are local and how the weighting is predisposed to a multitude of expensive home sales in populous provinces such as Ontario and B.C.

Winnipeg remains one of the most affordable housing markets with its single-family benchmark price of $338,800 at 39% of the national aggregate price. There are also lots of other affordable housing options to choose from besides single-family homes such as townhomes and condos. If you’re looking for a home in the new year, contact your neighbourhood REALTOR®.

Be well, stay safe and have a wonderful 2022.

Peter Squire is the Winnipeg Regional Real Estate Board’s Vice-President, External Relations & Market Intelligence.