The power and value of home ownership is life-changing as Habitat for Humanity’s CEO Sandy Hopkins recently discussed in an announcement of five new NetZero Habitat homes to be built in Winnipeg for five families. These families are cognizant of the opportunity they have been given to start building equity in a home they own. Just like the home itself, they now have a foundation to build on and stability knowing their children will be settled in a neighbourhood for many years to come.

Of course, not everyone qualifies for a Habitat home or a home on the open market as there are a number of requirements you need to meet. For the latter, you have to qualify for a mortgage for the home you wish to purchase, come up with the necessary down payment and closing costs (e.g. land transfer tax) and be mindful of other expenses you will incur to cover your operating costs of owning a home.

Nevertheless, the vast majority of Canadians aspire to owning their own home and even with rising interest rates (still low historically speaking), are undeterred in fulfilling the goal of home ownership. In a national opinion poll conducted by Earnscliffe Strategy Group for the Canadian Home Builders’ Association (CHBA), 3 out of 4 think when you are middle class you should be able to own a home while 75% of Canadians see home ownership as a key to financial security. It stands to reason then Canadians rank housing affordability as a top concern.

Another national survey conducted for the first time by Canada Mortgage and Housing Corporation (CMHC) this year digs further into what the expectations of Canadians are who intend to buy a home within the next two years. The following information was written by CMHC’s Carla Staresina for the Canadian Real Estate Association.

Prospective Home Buyers Survey

CMHC’s first ever Prospective Home Buyers Survey is a national, online survey that captures the attitudes and expectations of over 2,500 prime household decision-makers who intend to purchase a home within the next two years. The three groups of prospective buyers included in the survey were first-time buyers, previous owners, and current owners.

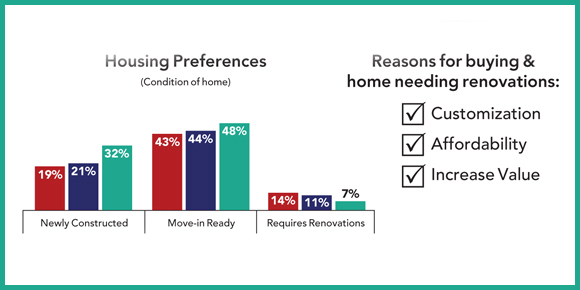

An existing move-in ready home is the top choice for all prospective home buyers. While the desire for a newly constructed house is higher among current homeowners, only about one-fifth of first-time buyers and previous homeowners are looking for brand new homes.

Purchasing an existing home that requires renovation is more appealing to first-time buyers and previous homeowners. The top reasons among all prospective home buyers for wanting to purchase a home that requires renovation are related to customization and affordability. Current owners are also driven by increasing the value of their home.

Single detached homes are preferred by the majority, especially by current homeowners. Apartments and condominiums are next, followed by semi-detached houses including duplex, and townhouses.

Maximum House Price

More than half of first-time buyers and previous homeowners are planning to spend less than $300,000 on the home they intend to purchase, while roughly one-quarter intend to spend between $300,000 to just under $500,000.

In comparison, one-third of current homeowners are planning to spend under $300,000, and a similar proportion is looking for options over the half-million dollar range. Most prospective home buyers from all groups say they cannot afford to pay more than what they plan to spend on their purchase.

Nevertheless, the majority of prospective home buyers feel confident they can find a suitable home they can afford, with first-time buyers showing less confidence than current owners. Nearly half of first-time buyers say they would delay their home purchase, with a fairly similar proportion saying they would be willing to compromise on the size of the home and location, should they not find their ideal home. Current homeowners are less likely to delay their purchase.

If you are considering making the transition to homeownership, utilizing the expertise of a trained and professional REALTOR® is an essential step. Your REALTOR® can help you with important decisions such as neighbourhoods, amenities and budgeting for a home. As your home is one of the most significant purchases you can make, you can trust in the knowledge of a REALTOR®.

— Canadian Real Estate Association