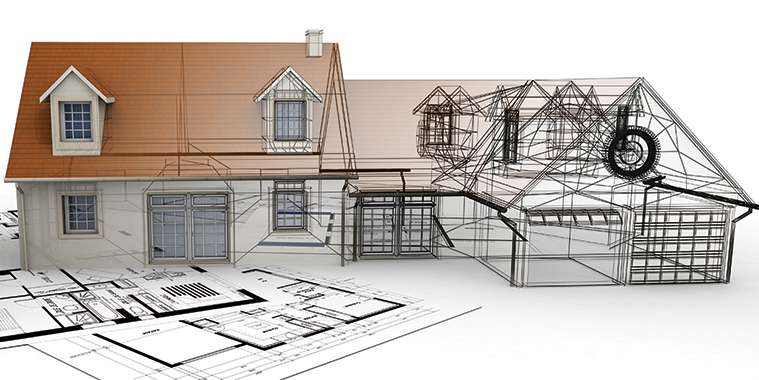

For most, the fantasy of building a dream home is just that — a fantasy: the perfectly styled gourmet kitchen, the shower big enough to fit an elephant and every tiny detail carefully considered to be exactly what you want.

With so much to consider, where do you begin? As always, a good place to start is with your budget.

The Basics: what is a construction mortgage?

If you want to build a home from scratch, or if you’re planning significant renovations or expansions to an existing property, a construction mortgage can help give you the financial framework to make it happen. Essentially, it begins as a loan to finance the build during the construction period. When the construction ends, the loan is due and it becomes a normal mortgage.

To qualify, you’ll likely need:

• Good to excellent credit

• A stable income

• Low debt-to-income ratio

• A down payment of 20%

Loan funds, totalling the full amount needed to complete the construction, are given to you in stages called “draws” throughout construction. Common stages include purchase of land, foundation, framing, lock-up (for example, doors, windows and roofing) and completion. The work is inspected by the lender at each stage to ensure it’s complete before the next draw is made available. Most lenders charge a fee for this inspection that goes beyond the cost of the loan. Also, keep in mind this inspection is different from the ones you’ll require as part of your permit, so be sure the work is up to code.

If you’re buying a new construction home through a builder, your construction loan is secured directly with them so you won’t need to get one yourself.

Starting point

First thing’s first: you need to consider what type of home you plan to build and how large you want it to be. Specific rules vary by province, so make sure you’re well informed before you start. You’ll likely want to (and may be required to) enlist the help of a licensed architect and/or engineer to help develop your plans.

When building, you might be inclined to align your build’s design with your wildest desires and whims. That might be fine for your forever home and if you have no intentions of ever leaving but, if future resale is a consideration, you might want to avoid unusual elements or unconventional floor plans. A REALTOR® is a great resource to help guide you through the most common and sought-after features of your neighbourhood.

Another consideration is the land you’re going to build on. Do you want to raise animals or have a farm? Is accessibility an issue or do you think it might be? How important is privacy? If you’re building a custom home to retire in, think about the future of that location and how its accessibility could factor in later in life.

Choose what you want, but choose wisely. If you are buying your own plot of land to build on (opposed to buying a new home through a builder with predetermined land) you may need a different type of loan. Vacant lots can come with higher interest rates and require larger deposits. Be sure to discuss your intentions with your bank so you can look at all of your options.

Getting the mortgage

A construction loan can be obtained at any major bank or broker. The loan can be a fixed or variable rate depending on your preference and payment needs.

Pro tip: fixed rate vs. variable rate

The difference between a fixed rate and a variable rate mortgage is fixed rates set the interest rate for the term of the loan, whereas the interest rate of a variable rate mortgage may go up or down depending on market conditions.

Be sure to ask your lender the draw dates and percentage payout of their loan, as well as their inspection fee at each phase.

Post-approval

Once you’re approved (congratulations!), the construction mortgage can secure the purchase of land with an initial draw or pay off any existing loan if the property has already been purchased.

You’ll be able to request subsequent draws from the lender as the construction moves forward, pending inspection.

Timing

Timing is the key to ensure everything runs smoothly. Consider the schedule around the completion of your project, including payment of subcontractors and inspection fees. You’ll also want to consider the sale of your current home or whether you’ll need to find a place to live in the meantime.

Post-construction

Once the scheduled construction is complete and on-time, the bank or lender will convert the loan into a mortgage with regular interest and principal payments.

A construction loan/mortgage, coupled with the assistance of licensed, professional trades and contractors, and your REALTOR®, could be the key to your dream home! Imagine the satisfaction from moving into a house tailor-made just for you.

— Realtor.ca