By Peter Squire

Since the pandemic first gripped Manitoba a year ago, many aspects of our lives have been affected, but condo sales — along with home sales — has not been one of them. The ascendancy of condominium sales activity in the Winnipeg Regional Real Estate Board market region in 2021 is nothing short of spectacular.

Starting with April 2020, listings coming into the month were at 6-month supply levels based on March sales of 133 ( if no new listings were to come on the market) — which is considered balanced — if not edging toward a buyers’ market where supply is a little more elevated than you want to see as a seller. Five months are more in keeping with a balanced market for condominiums. These 133 sales in March 2020 equated to 17% turnover of the existing condo listing inventory which at the end of the month was close to 800 listings.

We now know how last year’s economic shutdown negatively impacted both listings and sales in April — and to a lesser extent in May — when things started turning around at the end of that month. In April, condo sales plummeted 54% while listings decreased by 36%, and only 10% of the active listings were sold. May performed a little better but sales were still down 41% compared to the year before while listings fell 16%. There was still a healthy inventory of 800 listings available for sale going into June 2020. Dollar volume in May actually dropped 45%, 4% more than sales which is an indicator of softness in the strength of the condo market for pricing.

In June, single-family home sales took off and indicated a full market recovery was underway. However, the condo market did not experience the same rebound in activity. Sales were up 13%, almost half of the percentage increase in single-family sales, but we were starting to see a trend emerge where listing supply in comparison to the year before was less elevated.

If you combine the entire third quarter market activity by adding in August and September, condo sales really started to track more like single-family, which was performing exceptionally well with significant year-over-year percentage increases. This resulted in the listing supply starting to come down from previous years as at the end of September 2020 there were 722 listings compared to 855 in 2019.

The other thing that happened at the end of September is that year-to-date condo sales were finally starting to catch up to the previous year while single-family had already surpassed 2020 with a 13% upward trajectory and record-setting pace.

The last three months of 2020 truly showed the condo market was picking up to the extent that by year end, the 1,847 sales edged out the best condo year ever in 2014 (1,798 sales) and 2019 (1,750). What this also did — and the 61% increase in December sales over the same month the year before was a big contributing factor — is continue the trend to lower listing supply at month end. It was now down to 429 listings.

In addition to this development is the fact the number of active listings selling was double the percentage rate the year before (34% versus 17%). It means that based on record December sales of 149, there is less than 3 months of condo supply available in 2021. This clearly puts the condo market more in the seller’s favour. It was mentioned at the 2021 Market Insights event in February that this change from 2020 will help firm up condo pricing given how prices have been relatively flat the past number of years given a more elevated supply on resales and on new starts.

Fast forward to March 2021 and condo sales are becoming the story this year in terms of percentage sales gains over the previous year. The 288 condo sales this month are up 116.5% over March 2020. This is double the percentage increase which occurred with single-family home sales. The average sales price also shows an uptick as $248,000 in March 2021 compared to $239,000 in March 2020 and ahead of the $241,000 annual condo price recorded in 2020.

These record March condo sales translated to over half of the condo supply turning over and instead of the 6-month supply that was the case at the end of March 2020, we now have only two months supply going into April 2021 based on current sales activity. This certainly gives reason to feel confident condo average sale prices will remain above $240,000 in the second quarter and possibly edge up into the next price range of $250,000 to $259,999. It is also why more condo owners are deciding to list their property as March 2021 showed a 20.7% increase in new listings from 329 last year to 397 this year.

Historic low interest rates are also fueling condo sales as they are with other property types. However, when you see how single-family home average sale prices have gone up at a higher percentage rate than condo average sale prices in the last year — and there is now a $137,000 spread between the two main property types when you compare their March 2021 average sale prices — a flight to another affordable option for buyers is good reason for accelerated condo sales activity.

This becomes even more evident when you look at where all the sales activity is happening between the two property types. In March 2021, the busiest price range for condos was from $150,000 to $199,999 at over 21% and 85% of the 288 sales were from$100,000 to $349,999. In sharp contrast, nearly half or 43% percentage of single family home sales happened in these same price ranges and only the $250,000 to $299,999 and the $300,000 to $349,999 price ranges achieved market share percentages in the double-digits. The most active single-family price range at almost 18% was from $500,000 to $749,999, while the second busiest was from $350,000 to $399,999.

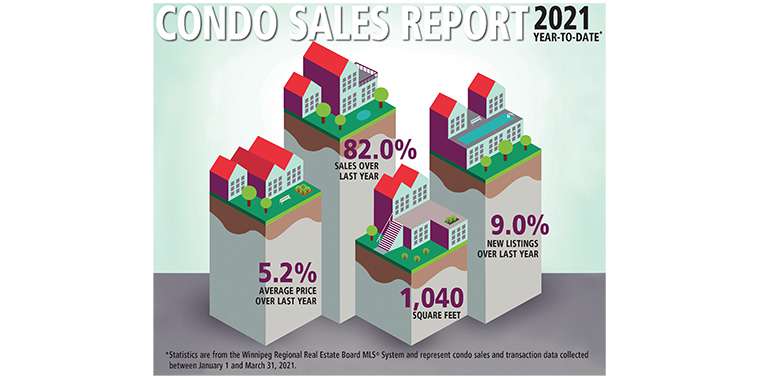

In summary, first quarter condo market activity is up significantly in 2021 with 579 sales compared to 319 in 2020, and dollar volume even doing better compared to last year with $139.8 million versus $73.2 million in 2020. The 1,015 condo listings entered on the MLS® in 2021 have risen 9% over 2020 and 57% of them sold versus 34% that sold last year.

What a difference a year makes when it comes to the local condo market.

Peter Squire is the Winnipeg Regional Real Estate Board’s Vice-President, External Relations & Market

Intelligence.