The Canadian Real Estate Association (CREA) — based in Ottawa and representing over 140,000

REALTOR® members working through 79 real estate boards and associations across Canada — provided a good background and some recommendations to federal MPs when REALTORS® met with them in October after the September federal election. Following is an excerpt of what they had to say:

“In the years leading up to the COVID-19 pandemic, low interest rates combined with record levels of international immigration and an increasingly middle-aged Millennial cohort continue to fuel very strong household formation and housing demand in Canada, particularly from first-time buyers. This has served to steadily draw down on available inventories and tighten market conditions. COVID-19 only served to supercharge trends that were already present, with even stronger first-time home buying activity teaming up with a surge in existing owners choosing to pull up stakes — everyone trying to find the right place to ride out the pandemic.

“During the 2021 Federal Election campaign, REALTORS® and the community of real estate boards and associations successfully ensured housing affordability and supply were top of mind. Above all, REALTORS® continue to advocate for policies to increase supply in Canada across the housing continuum.

“Demand-side policies over the last decade have limited how much households can borrow to get into the ownership space, but the bottom line when we consider population, households, and the housing stock across the entire housing spectrum, is that people need to live somewhere. When we see a shortage of affordable housing, along with record tightness in both the rental and ownership housing markets, it is clear that, regardless of tenure, what is needed is more units in Canada’s housing stock.

“Policies that increase the supply of homes across the housing continuum, and programs that enable people to adapt and improve their current properties, are best to address this goal.

“Increased housing supply is the key to solving the current housing crisis in Canada. However,

REALTORS® recognize there are additional measures that can be taken to help put homeownership in reach for more Canadians.

“The Home Buyers’ Plan (HBP) allows a first-time home buyer to withdraw from their registered retirement savings plans (RRSPs) to buy or build a qualifying house. RRSPs allow Canadians to plan for the twin goals of homeownership and retirement. It allows owners to make a bigger down payment to reduce their mortgage amount and lessen mortgage insurance costs. Currently, the withdrawal limit for an owner is $35,000. Additionally, longer-term mortgages for first-time buyers can be a meaningful way to reduce monthly payments by amortizing them over the longer term. With rising costs in housing markets across Canada, CREA recommends the RRSP withdrawal limit increase to $50,000 from $35,000. This would better align with current rising costs. CREA also suggests the government reintroduce the 30-year amortization for insured mortgages to assist young first-time home buyers. Data from Equifax shows young Canadians represent the lowest risk in terms of mortgage arrears. Extending the length of a mortgage improves affordability by reducing the size of monthly payments. These changes would allow greater flexibility in mortgage choice and lower payments, providing first-time buyers more opportunity for saving, spending or investing.”

The federal government — under a new department of Housing and Diversity and Inclusion — is on the same page with the need to increase housing supply and help first-time buyers achieve homeownership. The Honourable Amhed Hussen after his appointment to head it up tweeted: With a dedicated Ministry for Housing, we will continue to make it easier for Canadians to find an affordable place to call home & ending chronic homelessness. Let’s keep working!

Specifically targeted to first-time buyers — among a number of steps Hussen is looking at taking to help Canadians get a foothold in the ownership market — is proposing a new tax-free savings plan for Canadians under 40 to save up to $40,000 for a first home and withdraw it tax free without repayment required.

To do all that he has set out in his housing blueprint, Hussen understands full well that the federal government has to work closely with municipalities, provincial and territorial governments, as well as the private sector, to remove supply barriers in order to facilitate building more homes faster.

As for Manitoba, one clearly identified impediment or barrier to first-time buyers gaining entry to homeownership is its high land transfer tax (LTT). It has never been adjusted to reflect much higher house prices since it was introduced in 1987, other than increasing the highest tax rate from 1.5% to 2% for any amount over $200,000.

In 1987, the government’s case for introducing the tax was to offset the cost of operating the provincial land titles office. However, this office has since been outsourced. Home buyers in Manitoba face among the highest land transfer tax rates in the country. The tax is an added, upfront, unfinanceable cost burden for home buyers. It makes buying a home even more expensive. Young families and first-time buyers — the Manitobans who most need support to enter the

housing market — are hurt the most by this tax.

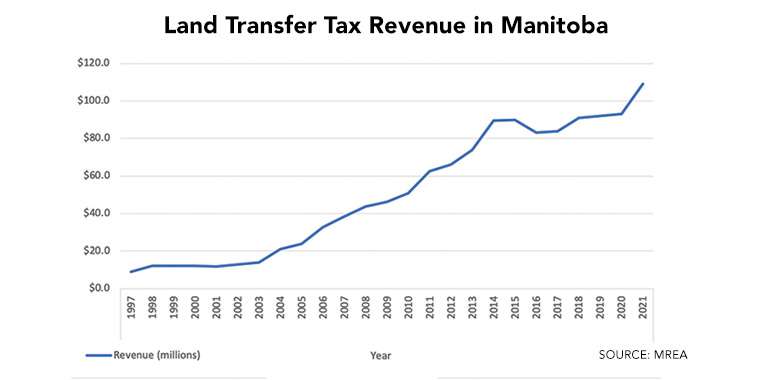

With unadjusted tax rates coupled with rising home prices, LTT revenue has skyrocketed in recent years — increasing elevenfold since 1997. In fact, the province’s Public Accounts for 2020-21 state $109 million in Land Transfer Tax revenue — a whopping 18% increase over 2019-20. The financial impact of this escalating tax on home buyers is significant. At the time it was implemented, the cost of the tax on an average-priced residential detached home was $250. Today, for an average priced home purchase, the LTT adds nearly $5,000 to the cost — in addition to the requisite down payment and other upfront closing costs.

The Manitoba Real Estate Association (MREA) is engaging with the Manitoba government as part of the 2022 pre-Budget Consultation process to pursue reforms to the tax. First-time buyers will continue to be a priority of REALTORS® in Manitoba as they work with all levels of government to advocate for homeownership and housing affordability.

Peter Squire is the Winnipeg Regional Real Estate Board’s Vice-President, External Relations & Market

Intelligence.