The strong sales performance in August resulted in year-to-date sales being ahead of last year’s pace for the first eight months of 2015. The lead 2014 had slipped away by the end of August due to an 11 per cent increase in sales in August this year.

On the other hand, dollar volume has remained ahead of 2014 throughout the year. In fact, August set a new dollar volume record for the month. There were over $340 million in MLS® transactions in August, with one single-family home fetching $2.1 million. Year-to-date dollar volume is now over $2.5 billion. It is up nearly three per cent over last year.

At 1,258 sales, August 2015 is up there with the best totals for the month. The three higher August month sales on record are moderately better, but none reached the 1,300 level.

As for listings, compared to the last few years, when there was a 25 per cent and 19 per cent increase in MLS® inventory by month-end over the previous year, this year’s 5,600 listings are more restrained. The total is up less than 10 per cent over August 2014 and down nearly 400 listings from last month.

Nevertheless, the healthy supply of listings, which roughly equates to four and one-half months on hand, has not gone unnoticed by buyers wishing to take advantage of historically favourable mortgage rates and some of the more affordable house prices in the country.

“At this point in the year, we are experiencing our fifth best sales year and dollar volume is ranked first and is poised to set a new record by year-end,” said WinnipegREALTORS® president Dave Mackenzie. “We are confident in the stability and consistency of Winnipeg’s real estate market. It really is symptomatic and reflective of a Manitoba economy that is diverse, resilient and performing well.”

Manitoba boasts one of the lowest unemployment rates in the country and has shown positive gains in job creation. Its unemployment rate has averaged 2.1 per cent below Canada’s rate over the past 15 years. Manitoba’s GDP is expected to be the third best in the country at 2.2 per cent in 2015.

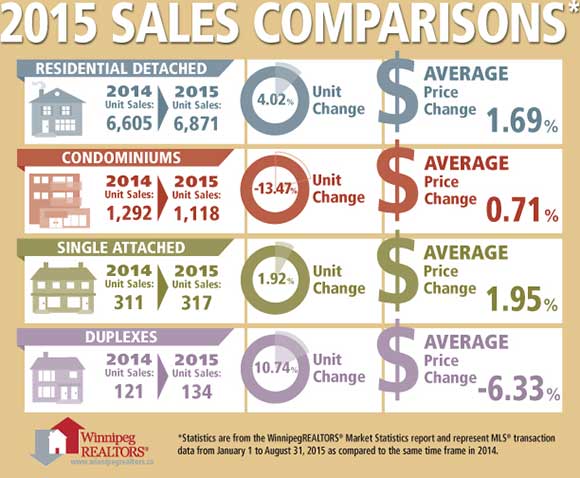

While condominium sales have been the subject of some concern this year, it should be put into perspective. Based on a five-year average of sales up until the end of August 2015, sales of 1,118 units are only down three per cent. The 160 condo sales — a 26 per cent increase — in August over the same month last year has narrowed the year-to-date deficit from 19 per cent at the end of July to 13 per cent at the end of August.

“Two things need to be kept in mind for condominiums in the context of our local market,” said Mackenzie. “Despite their gains in overall MLS® market share over the last few years at the expense of single-family homes, the latter still represents the lion’s share of our MLS® market activity. This year three out of every four sales is a single-family home, while condominiums have been closer to one-in-10 (12 per cent) of total MLS® market share.

“The second point is we still have four months to go and a month like we had in August shows the gap may be narrowed further before year-end,” he added.

The recent release of RBC’s housing affordability index for the 2015 second quarter is helpful in understanding where we stand in a national context. It shows that buying a Winnipeg detached bungalow — based on the pre-tax income needed to service the costs of owning a home at current market values — is right in line with Montreal and Ottawa, not far off from Calgary and Edmonton and well below Toronto and Vancouver.

RBC’s chief economist Craig Wright said that “home buyers in the province continue to face little undue pressure as affordability levels remain very close to historical norms.”

The most active price range in August for residential-detached sales was $250,000 to $299,999 (22 per cent of sales), followed by the $200,000 to $249,999 price range (17 per cent) and $300,000 to $349,999 (16 per cent).

The average days on market for residential-detached sales was 38, a week slower than August 2014.

The highest-priced residential-detached sale was a home in Headingley that sold for $2.1 million. The least expensive sale was for $35,000.

The busiest condo price range in August was $150,000 to $199,999 (31 per cent of sales), followed by $200,000 to $249,999 (22 per cent) and $250,000 to $299,999 (19 per cent).

The average days on the market for condominium sales was 55, two weeks slower than August 2014.

The highest-priced condo sale was for $501,000 and the lowest-priced sale was for $60,000.