It’s looking like we’re going to be seeing similar real estate trends in 2023 compared to last year.

Following a year defined by market highs and lows, experts are forecasting a gradual return to a more balanced market towards the end of 2023. However, with inflation remaining more or less unchanged at the tail-end of 2022, last year’s trend of diminished purchasing power seems likely to persist.

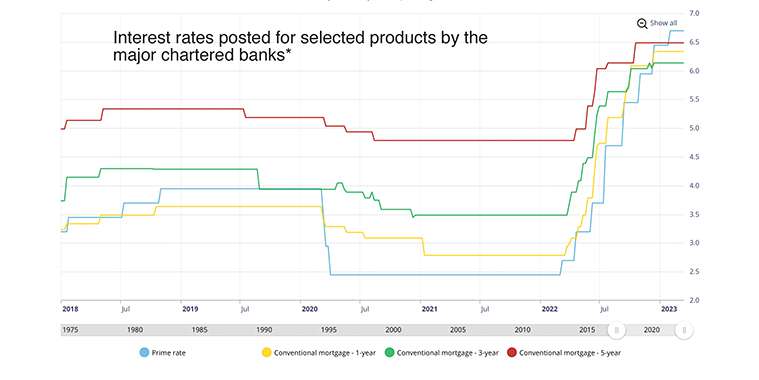

As for what that means for mortgage lending, Shaun Cathcart, Senior Economist at the Canadian Real Estate Association (CREA), predicts primary-based mortgage payments will continue to rise dramatically until the Bank of Canada (BoC) reaches its terminal rate.

Variable rate mortgages

“The ‘terminal rate’ as it’s called — meaning where they’re expected to stop — has gone from 3.5% on the overnight rate back in the spring to closer to 4.5% now,” writes Cathcart.

As such, those carrying variable rate mortgages are now facing their “trigger rates,” meaning those borrowers will face higher monthly payments if interest rates remain high.

In December 2022, Canada’s inflation rate fell 0.6% from the previous month to 6.3% which will certainly inform the BoC’s next interest rate decisions. If more hikes happen this year, variable rate mortgage carriers will not only find themselves with high monthly payments to cope with, but those payments are likely to cover more interest and less of the loan’s principal amount, translating to a longer payback period overall.

Meanwhile, data from the British Columbia Real Estate Association (BCREA) forecasts the average Canadian variable mortgage rate will rise to 6.35% in the first half of 2023, decreasing “only slightly” to 6.1% in Q3 2023 and 5.85% in Q4 2023.

Fixed rate mortgages

At present, variable rate mortgages have higher monthly payments than fixed rate mortgage payments. However, Cathcart cautions “those with fixed rate mortgages are not safe for the next five years.”

He continues, “[fixed rate mortgages] come up for renewal every day. People paying attention are rightfully worried. People who have not been paying attention could be in for some serious sticker shock.”

According to data from Ratehub, the five-year fixed rate in 2018 was 2.94%. At the end of 2022, it had increased to 4.54%. For a $400,000 mortgage on a 25-year term, this would mean monthly payments increased from $1,881 to $2,223.

Predicting where rates are heading in 2023 will continue to be a challenge given the uncertainty of the economy and real estate market, which will leave fixed-rate carriers to speculate where the market might be headed and whether it’s more prudent to lock in a short- or long-term fixed rate.

What new borrowers can expect

Substantial rate hikes are most likely behind Canadians, and consumers have had some time to adjust their spending and home buying budgets accordingly. If prospective buyers return to the market, things could heat up once again as low inventory continues to be an issue across Canada.

Of course, depending on the Bank of Canada’s next moves, things could go another way. The high cost of borrowing could also keep prospective buyers on the sidelines, which could serve to lower demand, curb competition, and soften Canadian housing markets. It’s truly too soon to tell.

In any case, Canada’s population is rapidly growing and housing demand isn’t going anywhere. Instead, demand will likely be absorbed in the rental market, according to Cathcart.

“In that sense, this is a continuation of the same story — those who got into the market early are unlikely to be affected by rapidly rising rates and are also unlikely to see the value of their properties decline all that much from the peak. Meanwhile, those who bought recently at elevated prices, and those in the rental market, may be in for a tougher ride over the next few years.”

If you’re thinking of buying or selling this year, visit www.winnipegregionalrealestatenews.com to find a local REALTOR® to get their professional expertise on what’s going on in the market where you live (or might like to) and what your best options are.

— Realtor.ca