By Peter Squire

September 2022 sales are no match for the last two exceptionally active Septembers as sales decreased 20% and 32% from 2021 and 2020 respectively. The 1,205 MLS® sales transacted this September are much more aligned with the most immediate prepandemic year of 2019 which had 1,211 sales.

While sales decreased 11% over the 5-year average, new listings coming onto the market in September are up 12% from last year and only down 1% over the 5-year average, so the combination of fewer sales and more listings is helping restore balance to a local market that had been well entrenched in sellers’ market territory earlier in the year. As a result, active listings — or current inventory of 3,897 at month-end — is up 37%.

“September is a continuation of the progression in the third quarter of our market region, transitioning out of a sellers’ market to one far more balanced and buyer friendly,” said Akash Bedi, 2022 President of the Winnipeg Regional Real Estate Board. “As we saw in August, above-list price sales are far fewer now than earlier in the year, with the majority of listings selling for less than list price.”

If it is a September to remember, it will be for the marked shift in the number of MLS® areas that experienced a significant drop-off in the elevated level and percentage of listings that were being converted to sales in comparison to the nine-month period last year. Thirty-four distinct MLS® areas had percentage conversions of 89% or higher in 2021 compared to only three this year. The highest one this year at 93% conversion is Tyndall Park. Second was Mandalay West at 90%.

On the other hand, an MLS® area like Waverley West only has 265 sales and a conversion of just 68% this year in comparison to 2021 when it had 395 sales in the first three quarters and an 89% conversion of listings to sales.

With respect to the third quarter, a telltale sign of changing conditions comes from going back to the second quarter, when comparing it to last year and looking specifically at the average single-family sales price. The gap from one quarter to the next has narrowed considerably in just one quarter.

This year’s second quarter was $442,134 which is in sharp contrast to $388,421 in the second quarter of 2021, whereas the third quarter of 2022 is at $391,802 while the same period in 2021 was far less at $374,810. This gap will likely shrink further in the fourth quarter and may come to the point where last year’s average single-family sales price will be higher than this year.

For condominiums, the third quarter average sales price increased over the second quarter, albeit minimally, as it went from $267,159 to $268,432. The second quarter and third quarter numbers for 2021 were similar, with the second quarter higher at $246,593 compared to $243,734 in the third quarter.

“The urgency attached to last year’s market activity at this time of year is gone,” said Bedi.

Year-to-date MLS® sales of 12,156 decreased 18% from the same period in 2021, while the dollar volume of $4.57 billion is down 10 percentage points less at 8%. The 18,435 listings entered onto the MLS® this year has improved significantly from the first two quarters, with the deficit reduced from over 20% to 4% with three months to go.

Helping move some buyers off the pause button and into action may well be the lower prices being asked despite the higher financing costs. In September, CREA’s MLS® Home Price Index (HPI), which provides the most accurate detection of price trends, shows the single-family benchmark price for a home with similar attributes dropped from $361,500 in August to $354,600 in September. It reached its peak in May at $388,600. Even condo apartments in September, which were only $600 off their peak level in August at $233,400, declined $5,200 to $228,200.

“Relative to other major housing markets in the country, our prices are much more affordable and within reach of potential first-time buyers,” said Bedi. “Evidence of that possibility is in the northeast area of Winnipeg with an average house price of $336,134 in September, and sales were just shy of their total in September 2021.”

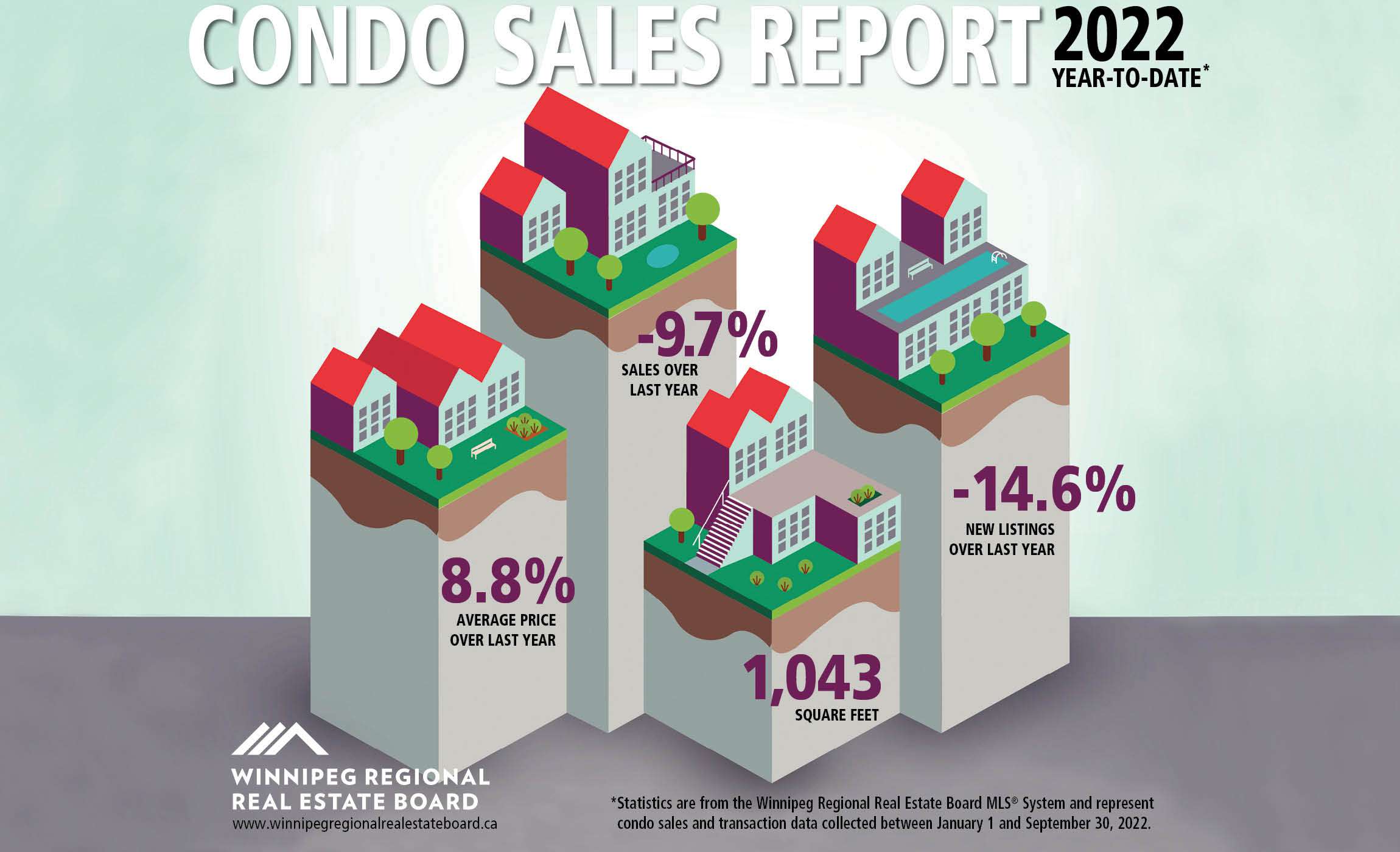

As for the more affordable condominium property type, while sales dropped off in September, like most property types with the exception of mobile homes and vacant land with a building, year-to-date condo activity for the first nine months of the year is performing well.

Sales have decreased less than 10% compared to the same time last year when they were up 49% over the prior year and ended 2021 shattering previous highs by leapfrogging to over 2,500 sales when they totalled 1,847 in 2020. They will eclipse 2,000 for the second year in a row this year.

Conversions of listings to sales are higher this year at 70% when they were 66% in 2021. In contrast, single-family has seen its conversions slow down considerably from its very high rate in 2021.

“The Winnipeg Regional Real Estate Board cannot recall ever seeing condominiums record an annual conversion of listings to sales as high as the dominant single-family property type category,” said Bedi. “It has now, with both at 70% for 2022.”

September condo sales showed upper market price range strength with 9 sales over $500,000 when there were none in September 2021. The highest condo sold for $1,160,000. The most active price range was from $150,000 to $199,999 at 24%.

“If you are selling in changing market conditions, you need to talk to your REALTOR® about accurate pricing and the right strategy to make your property stand out from increased competition,” said the Winnipeg Regional Real Estate Board CEO Marina R. James. “A professional marketing plan will reach the maximum number of buyers.”

Peter Squire is the Winnipeg Regional Real Estate

Board’s Vice-President External Relations & Market

Intelligence.