By Peter Squire

All markets are local.

This is something national reporters in overheated and overpriced housing markets such as Toronto and Vancouver overlook and do not always understand. They write about prices being out of reach for most Canadians. They state how irresponsible our government would be if it extended a 25-year amortization to 30 years for a first-time buyer — even though Equifax shows young Canadians represent the lowest risk in mortgage arrears. Or if

the government considers being more flexible when applying the current B-20 Mortgage Stress Test — essentially a one size fits all policy for the entire country — to a city like Winnipeg where no allowances are currently being made for local market conditions.

These reporters are quite frankly placing their own market bias on an entire country which behaves quite differently based on local economic and market factors. Shouldn’t policies and programs that will affect housing markets across the country fit the realities of what is happening within each unique region? As the Canadian Real Estate Association (CREA) pointed out in one of their federal election proposals to reform the mortgage stress test, a specific test should be applied to each regional housing market that would consider local factors such as housing market activity, average cost of a home in that market, employment levels, average income and cost of living.

A case in point in some of the discussion around dealing constructively to mitigate increasing housing prices is spurring on more housing supply in major markets such as the GTA (Toronto) where there’s a shortage. When reading real estate articles, increasing housing supply comes up frequently as a good solution, and rightly so if you are under-supplied in both new and existing resale inventory. This then begs the question: Does everyone have a housing supply shortage like they do? Not all markets have this same issue of severe housing shortages or significant deficiencies.

Let’s examine Winnipeg’s housing market.

While Winnipeg has been singled out by CREA in its national monthly MLS® market releases for performing exceedingly well in August, it also notes that housing inventory has “swollen far beyond long-term averages in the Prairie provinces and Newfoundland & Labrador, giving homebuyers ample choice in these regions.”

Listings at the end of August and September, where sales in particular start to recede from the busier third quarter of market activity, were in excess of 6,000 available for sale. This number represents a 17 per cent increase over 2018 and 30 per cent more listings to choose from in 2019 as October commences. It therefore puts pressure on prices to hold their position with vendors knowing competition for buyers can be fierce with that many more homes available for them to buy.

In Canadian Mortgage and Housing Corporation’s (CMHC) housing market assessment report where it related to Winnipeg, they indicated in the first quarter of 2019 that there was no evidence of overheating, and price acceleration was low with minimal change in prices due in part to a sales-to-new-listings ratio under 60 per cent. However, CMHC did detect an overvaluation and overbuilding of new housing inventory in Winnipeg’s Census Metropolitan Area (CMA) which left us at moderate in their rating. Single-detached units were singled out as being very high in terms of inventory of completed and unabsorbed units.

If you look at WinnipegREALTORS® average single family and condo prices at the end of September — in comparison to the same period last year — you are talking marginal change in price movement up or down. Single family homes are at $325,215 versus $322,828 in 2018, while condominiums are at $238,820 in comparison to $239,877 last year.

A local housing market seeing some downward pressure on house prices this year is Regina, where Royal LePage just reported that their average house price dropped 5.9 per cent year over year in the third quarter.

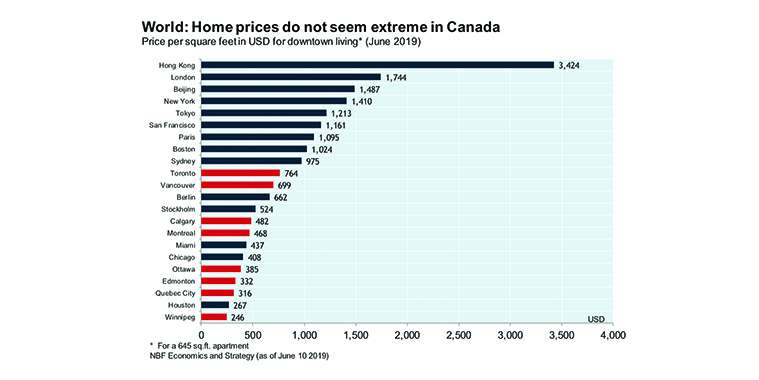

The bottom line is Canadian housing markets perform as differently at home as they do around the world. See the above chart from National Bank of Canada to understand just how well Winnipeg is placed to accommodate home buyers without the need for government intervention.

All levels of government need to take local market conditions into account when developing and administering housing policies and programs. CREA continues to advocate for these changes.

Peter Squire is WinnipegREALTORS® Vice-President, External Relations & Market Intelligence.