By Peter Squire

After two consecutive years of virtual Political Action Committee (PAC Days) meetings, this October marked the return of more than 400 REALTORS® from across the country descending on Ottawa to meet with their federal riding MPs on issues important to Canadians.

With more than 150,000 members, REALTORS® make up one of the largest single industry associations in Canada, and are drivers of our economy. In 2018 alone, resale housing transactions through Canadian MLS® Systems generated an estimated $32 billion in spin-off consumer spending and more than 234,000 jobs.

The Canadian Real Estate Association (CREA) represents REALTORS® on Parliament Hill and is a strong voice in the nation’s capital advocating on behalf of homeowners, aspiring homeowners, and the communities in which they live.

What became abundantly clear at this year’s gathering is the magnitude of the housing supply and affordability issue; one that is significant and widespread from major cities to smaller communities throughout Canada.

Middle-class families, millennials and new Canadians have found it increasingly difficult to buy their first home, while ambitions of homeownership remain strong despite the barrier of affordability. CREA has consistently advocated for policy and regulation that allows more Canadians to enter the housing market and enjoy the benefits of settling into a home that is truly their own. CREA’s recent advocacy efforts have successfully made housing a focal point of the federal government’s public policy initiatives.

One policy change that comes to mind is the long-standing Home Buyers Plan (HBP) which CREA was instrumental in getting implemented in 1992. The HBP withdrawal limit has been raised from $25,000 to $35,000, allowing greater access to one’s own savings to purchase a home. Eligibility for the HBP has also been expanded to those undergoing significant life changes, such as marital breakdown. To date, the HBP has helped close to three million Canadians buy their first home.

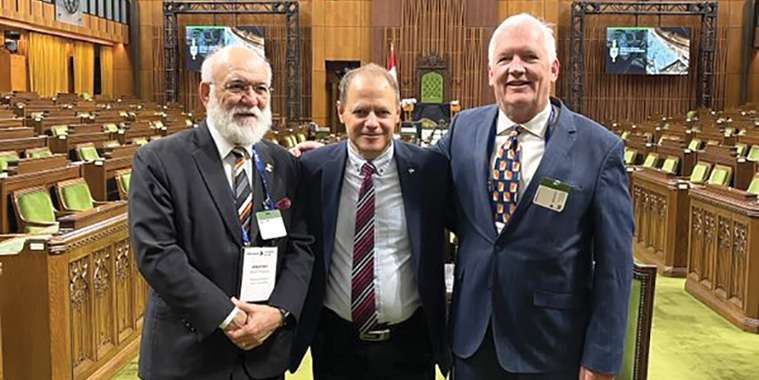

Winnipeg North MP Kevin Lamoureux, and local political action representative REALTOR® Kourosh Doustshenas, worked together on a petition which was introduced in the House of Commons in support of the enhancements cited above. More help came in this year’s federal budget with the doubling of the first-time homebuyer tax credit from $750 to $1,500, and the introduction of a tax-free first home savings account (FHSA) which allows you to save up to $40,000 on a tax-free basis with an annual $8,000 contribution limit. An FHSA can hold the same qualified investments that are currently allowed to be held in a TFSA.

CREA’s senior economist, Shaun Cathcart, briefed REALTORS® at this year’s PAC Days on how the pandemic has exacerbated a concerning trend that has been decades in the making, but became more problematic around the second half of 2019: a lack of housing supply. Even with the market softening now with the 300 basis point rate hikes, months of active listing supply are only getting back to a previous low set 20 years ago, while the 3.5 month national average inventory is still below the long-term average of 5 months. After the Bank of Canada winds up its rate tightening cycle, Cathcart expects the fundamental imbalance of the number of people needing a place to live and the housing stock that currently exists to continue.

So how do we find solutions to deal with our housing supply issue? Two recommendations were brought forward to federal MPs in this regard. They were formed on the basis that we need a comprehensive national approach to identify changes that could increase the responsiveness of housing supply to demand. It needs to address supply issues across the entire housing spectrum, including those most vulnerable while allowing more Canadians to gain stability and opportunity through homeownership.

The first recommendation is to establish a permanent national housing roundtable bringing together federal, provincial/territorial and municipal authorities, along with builders, real estate professionals and civil society organizations. CREA and REALTORS® will bring their market expertise to bear through well-researched reports and a wealth of solid data-informed perspectives to identify priority issues and deliver solutions to various market challenges. As members of the roundtable, different industry professionals can identify where and what supply is needed, so governments can take effective action.

The second recommendation is leveraging infrastructure funding, such as the bilateral agreements through the Investing in Canada Infrastructure Program, to ensure housing becomes a key component within them. Federal infrastructure funding should be leveraged to incentivize provinces, territories and municipalities to speed up approvals and permitting, stimulate more density as is the case in Manitoba, and other means, like revising zoning to get more housing built in existing neighbourhoods at a lower cost.

The federal government has a perfect window of opportunity to deliver on increasing housing supply through its infrastructure funding right now in Winnipeg. It is called CentrePort South, and both the City of Winnipeg and the provincial levels of government have stepped up with major financial commitments to commence the first phase. Just last week, the Manitoba government announced they will invest up to $40 million in servicing infrastructure to support its development, as the City has already committed $20 million and are now awaiting the federal government to come through with its cost-matching $20 million.

Not only will this development be a game-changer for Winnipeg in providing it with much needed employment and industrial land to take advantage of the very successful tri-modal inland port, it facilitates the provision of 500 acres of residential development to house 12,000 people. The bottom line is that more housing supply helps keep housing prices affordable.

According to the federal Minister of Housing, Diversity and Inclusion, The Honourable Ahmed Hussen, at CREA’s annual PAC Days conference, said he would embrace the initiative taken by the other levels of government. In a well-received speech before an attentive REALTOR® audience, he stated, “We will provide incentives and leverage federal funding through infrastructure, for example, to demand better outcomes on housing.” If the Minister follows through, it could make a project like Centreport South a reality.

Let’s get on with it!

Peter Squire is the Winnipeg Regional Real Estate Board’s Vice-President External Relations & Market Intelligence.