By Peter Squire

According to national headlines, the real estate market is experiencing some major corrections. But given the fact that all markets are local, this is a timely reminder to read beyond those headlines.

If it is raining in Vancouver in January, this does not mean the same in Winnipeg. As we know too well, we’re more likely to be experiencing a blizzard. And as for summer, who is even looking at other cities’ weather given Winnipeg’s summer has been terrific and hopefully will continue well into September.

The most recent national market release from the Canadian Real Estate Association (CREA) was very careful to explain that markets vary considerably across our country, as exemplified in the following quote from CREA’s chair, Jill Oudil: “July saw a continuation of the trends we’ve been watching unfold for a few months now; sales winding down and prices easing in some relatively more expensive parts of the country as well as places where prices rose most over the past two years.”

In a column published in this space in 2021, it was mentioned how the GTA market’s MLS® Home Price Index (HPI) single-family benchmark price from December 2020 to December 2021 went up over $300,000 from $1,063,900 to $1,432,500. The increase is actually $368,600. This equates to 54% of all the single-family home sales that took place in the Winnipeg Regional Real Estate Board market in 2021, or 6,833 sales falling under this amount. As for condominiums, 2,210 of the record 2,572 condo sales sold for under $368,800 — or 86% of total sales in 2021.

While showing you a stark contrast in these two entirely different housing markets, the Winnipeg Regional Real Estate Board’s MLS® HPI single-family home increase went from $310,800 in 2020 to $347,600 by the end of 2021. This was notable for our local market in that for the first time in years we saw an increase in the double-digits of 10.6 %. However, when you look at the multiple ten-fold increase in the Greater Toronto Area (GTA) over Winnipeg’s more modest upward price movement, that’s when you really begin to appreciate that all markets are local in their make-up.

To bring you up to date, the GTA has seen its year-end 2021 HPI of $1,432,500 drop back to $1,361,100 in July of this year, while our local market is still up nearly $20,000 — to $367,200 — from the 2021 year-end of $347,600. Prices , however, have been higher this year since May was the peak month in our market at $388,600 and in the GTA January was remarkable at $1,603,800.

With regards to the MLS® HPI, it is important to note that for apartment condominiums in the Winnipeg Regional Real Estate Board market, prices are holding firm and are even up modestly, as July 2022’s HPI benchmark price was $234,000, up $15,700 from the end of 2021 and up $4,900 from the end of May 2022.

One indicator of differences between local markets is CREA’s months of inventory available for sale. Its seasonally adjusted number is a better reflection of what is happening as this year evolves. Currently its 4.7 months for B.C. and only 2.3 months for Manitoba.

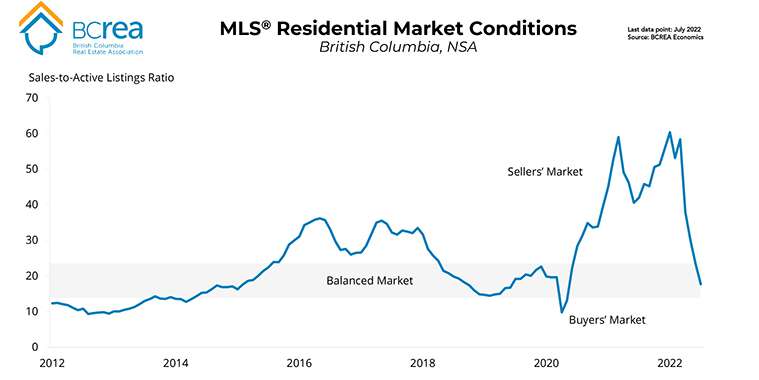

Speaking of B.C., the chart above was supplied by the British Columbia Real Estate Association (BCREA) and is another way of underscoring how Manitoba, specifically, is not anywhere near the stage B.C. is at in moving toward a balanced market from a sellers’, and from there, potentially heading into a buyers’ market with 5 months still remaining in 2022.

You can see the dramatic drop in the sales to active listings ratio for residential property sales from the start of 2022 to the point where it is now well within the balanced market range at less than 20% and approaching buyers’ market ratios. While not a direct comparison to B.C. since we do not have the exact Manitoba ratio, the July ratio looks to be around 37% which is still clearly in seller’s market territory. This makes sense given how B.C.’s monthly listing inventory is more than double Manitoba’s.

In looking at the Winnipeg Regional Real Estate Board’s sales to active listings ratio for single-family and condominiums, they are at 55% and 47% respectively. However, it is important to point out that, like B.C., at least in respect to single-family homes, we are clearly seeing a shift towards a balanced market compared to a very heated one last year as July 2021 shows a sales to active listings ratio for single-family of 91%. However, condominiums are showing an increase in their sales to listings ratio in July 2022 as they were at 37% in July 2021. Condo sales this July were only two behind a very strong sales performance last July.

All of this is to say that markets within a country and within various MLS® property types behave very differently, so it is important not to assume a national headline is talking about your property type in your local market.

On a final point with respect to our local Winnipeg Regional Real Estate Board market, there have only been two years in the last 45 when the annual average single-family home sales price dropped from the previous year. The first time was in 1982 when the average sales price slipped back from $55,231 to $53,994, but it strongly recovered the next year to post a big increase at the time of over $5,000 to end up at $59,498. The second time was in 1995 when the average sales price decreased from $89,352 in 1994 to $87,387. However, it also bounced back the next year to $90,047.

The Winnipeg Regional Real Estate Board’s year-to-date average single-family sales price is still well ahead of last year’s despite the monthly average coming well off its peak in May. As always, you can rely on up-to-date market analysis from the Board as the year progresses. It is important to be attuned to what is happening here, not in markets like the GTA and B.C. where much higher prices are more interest rate sensitive and susceptible to falling significantly more.

If you’re ready to enter the housing market, take Oudil’s advice. She says, “As the market continues to evolve, your best bet is to contact your local REALTOR® for information and guidance on how to navigate the current environment.”

Peter Squire is the Winnipeg Regional Real Estate Board’s Vice-President External Relations & Market Intelligence.