By Peter Squire

The coronavirus pandemic seems to have spawned a whole new series of blue sky predictions about what will happen to the real estate market.

We all know that we are in unchartered territory with Covid-19, the affects of which Canada hasn’t experienced since the Spanish influenza pandemic of 1918. But since we’re still in the middle of it, we have no idea how it will play out economically.

However, that hasn’t stopped Canada Mortgage and Housing Corporation (CMHC) from projecting as far as the end of 2022 — and being quite pessimistic about housing prices in particular. CMHC has always done what they call stress tests on the risk to their insurance portfolio, creating different scenarios based on current market events from which to create their projections. As a result, CMHC’s chief economist, Bob Dugan, said prices in Canada and Ontario will not return to pre-recession prices until late 2022.

Understandably, there has been some pushback on this projection from industry officials, such as Christopher Alexander, regional director of RE/MAX for the Ontario-Atlantic region, and Phil Soper, CEO of Royal LePage. Both shared similar sentiments regarding how it’s possible to project over two years when we are so focussed on week-to-week or even month-to-month activity during this pandemic.

Soper also talked about Canada’s mortgage default rate being very low at one-quarter of one percent. The federal government, Bank of Canada and various financial institutions have really stepped up by injecting liquidity into the economy, as well as providing six-month mortgage payment deferrals to help Canadians avoid default until the Canadian economy kicks into recovery mode — as it is already doing in a number of provinces.

Robert Hogue, RBC’s senior economist, in his report (which came out about the same time as CMHC’s) was not so dire and more circumspect on what he thinks will happen in the short term. He really feels prices will hold, with the exception of already hard-hit cities prior to the pandemic, such as Calgary.

Hogue also thinks April may have been the bottom of the sales decline now that there are signs of economic recovery. He does admit that longer term we may see price weakness, depending on how well employment comes back after its noticable decline this spring. However, if it does bounce back, market conditions could prevail again in some housing markets.

Then you have one of the leading national housing economists in the country, Altus Group’s Peter Norman, who recently told Larysa Harapyn of the Financial Post, “Don’t under-estimate how things may come back”. Norman was quite bullish on how the industry is adapting and using technology to work their way through issues of social distancing.

So where does Winnipeg fit into all of this pandemic chatter?

The first important point is to remember that all markets are local — and there are clearly regional distinctions which apply. While all markets will benefit from some of the lowest interest rates in Canadian

history (which shouldn’t change for the foreseeable future), some provincial economies, like Manitoba’s, are more diverse and stable than others. Barring any unexpected disruption and therefore delay to its progress on flattening the coronavirus curve, Manitoba is making good progress at reopening its economy — and will continue to do better in June.

In April, WinnipegREALTORS® market showed some of its resiliency, with sales down only 30 per cent in comparison to many major markets like Toronto, Calgary and Montreal experiencing at least double this amount. Keeping in mind that May 2019 was WinnipegREALTORS® best month on record — with 1,705 Multiple Listing Service® (MLS®) sales — it is totally understandable that May 2020 will struggle to stay close to that given our economic shutdown.

There is hope, however, that with the reopening of open houses this month — with public health safety measures uppermost in REALTORS® minds — Manitobans will slowly start engaging in the market as they may have originally been planning prior to the pandemic taking hold of their lives.

As for prices, which are some of the most affordable in the country — and which have been stable and steady over a number of years — evidence for the first four months of this year including April shows no price compression.

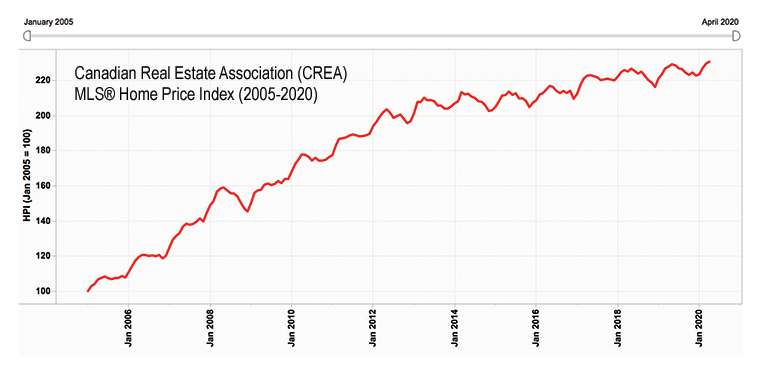

In fact, for the overall composite house price as shown in Canadian Real Estate Association’s (CREA) MLS® Home Price Index (HPI) in the chart above, Winnipeg’s index increased from 223.2 in January to 230.5 in April. CREA’s HPI uses January 2005 as the baseline at 100, and then tracks monthly prices for this market region every month using a typical home that is synonymous with our region. This means that we have seen a 130.5 per cent increase in house prices since January 2005.

Since WinnipegREALTORS® market region is dominated by single-family home sales (over 70% market share on its MLS®) in comparison to other property types — and is primarily lifestyle in its make-up rather than in investment, as you might see in other cities such as Vancouver — it can be said that the majority of buyers in this market are looking at a home as a long-term investment for their own health and well being. The health part has been reinforced during this pandemic with Manitobans staying in the sanctity of their home to feel safe.

You may even say “health and wealth”, as housing as an investment in our local market has been very reliable and steady as a retirement nest egg. There is no reason to doubt that it will not continue well after we put the pandemic in our rear view mirrors.

Peter Squire is WinnipegREALTORS® Vice-President, External Relations & Market Intelligence.