By Peter Squire

As Manitoba flattens the COVID-19 curve, the gradual reopening of the economy has finally commenced — with a plan to open even more non-essential businesses next month — in what is now called the “new normal” with social distancing guidelines firmly in place.

Just as we are seeing differing results across the country in how many coronavirus cases are being detected, the same can be said for real estate activity. Because markets are local, this has always been the case prior to the coronavirus putting a vice-grip on our daily lives. For example, the housing markets in the oil producing provinces of Alberta, Saskatchewan, and Newfoundland and Labrador were already reeling with less than stellar performances due to the well documented struggles of the oil and gas sector. And then you have sky-high housing markets such as Vancouver and Toronto which are difficult for any Canadian to relate to from living in far more affordable housing markets such as Winnipeg.

So when you see headlines about plunges in sales activity in the Greater Toronto Area (GTA) of 67%

in April or a drop in average sales price of 12%, with Calgary down 64% in sales and Vancouver off by 62% based on their 10-year average sales for April, this does not mean all markets are seeing this same kind of drop-off in sales or prices.

Winnipeg has fared much better with only a 30% decline in Multiple Listing Service® sales. While pricing is not directly addressed, CREA’s MLS® Housing Price Index (which Winnipeg is now included in as of this year), shows our overall benchmark price is remaining stable through the first four months of 2020. The composite price for Winnipeg in April was $275,000 compared to $270,500 in March and $269,300 in January. For a single family two storey home the price went from $291,100 in March to $301,200 in April. Where our market is soft — and that is not a new development due to elevated supply in the last few years — is in apartment condos, where the housing benchmark price in April dropped to $187,300 from $191,700 in March.

Going forward — with our industry taking its own measures to facilitate safe transactions in these times — there is hope for improvement in the degree of spring market activity we can expect to see with the negative impact of the coronavirus still weighing heavily on Manitobans.

May 2019 happened to be the best month in WinnipegREALTORS® history with 1,705 MLS® sales and over 3,000 new listings entered on the market, so obviously expectations based on this month are lower.

Following the best first quarter market results in WinnipegREALTORS® history, the shutdown of the economy to control COVID-19 put the brakes on the market with a reduction in sales and listings.

Multiple Listing Service® sales of 851 were down 30% while the 1,568 new listings entered on the market in April decreased 42% compared to April 2019. A number of prospective sellers and

buyers took a wait-and-see approach to what usually is a big jump in activity to kick off the spring market. Overall inventory of listings available for sale remain at a healthy level of 4,466, slightly down 3% from the 5-year average.

Despite this monthly dip in sales, year-to-date sales of 3,511 are just 2% behind the same period in 2019 and 3% down from the 5-year average. Year-to-date dollar volume of just over $1 billion is down 3% from 2019. Similar to sales, dollar volume was off to its fastest three month start with close to a 13% increase over the previous year.

“To be expected, the local real estate market felt the impact of government stay-at-home measures to put the economy on hold to protect Manitobans’ health and well-being,” said Catherine Schellenberg, president of WinnipegREALTORS®. “These measures have been well heeded by everyone to the extent that we can now start to reopen the economy. REALTORS® are adjusting their practices to ensure transactions are safe.”

Government measures to protect Manitobans from COVID-19 hit condominium sales with a 53% decrease in sales in April. However, one of those sales set a new record high price for luxury condominiums at $1,790,000. This result shows confidence in investing in the future of our local market as real estate is a long-term investment.

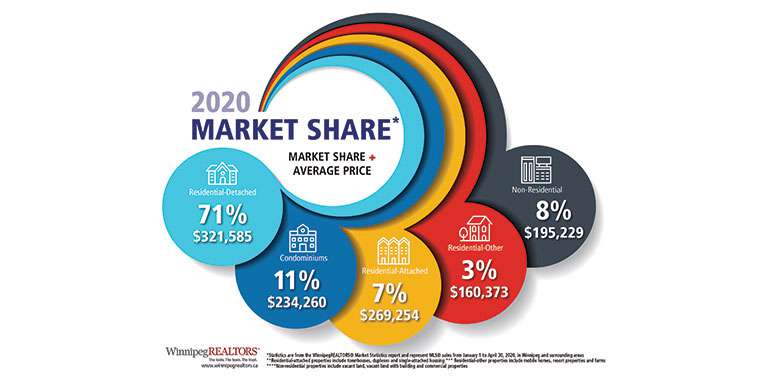

Residential-detached sales, which make up 71% of total Multiple Listing Service® sales, were down 32% compared to April 2019, but are just down 2% for the year. It is also worth noting that 20% of the sales in April went for above list price and that equaled the above list price percentage that sold in 2019. Condominium sales did not fare as well with just 5% selling for above list price.

Some other property types fared better, with single-attached down less than 5% in April and mobile homes up a whopping 400%.

As for price range sales activity, nearly 80% of all condominium sales happened from $100,000 to $299,999 with the most active price range at the 24% market share from $150,000 to $199,999. For residential-detached properties, 72% of all sales in April were from $200,000 to $449,999. The most active price range was from $250,000 to $299,999 at 21%.

“With the Manitoba government announcing its economic recovery plan last week, which includes a gradual reopening of the economy this month, REALTORS® can return to the practice of hosting open houses under new measures,” said Schellenberg. “Your REALTOR® can guide you through the process while ensuring that health and safety remains a top priority.”

“You can count on your REALTOR® to facilitate the buying and selling of the real estate process safely and professionally,” said Marina R. James, CEO of WinnipegREALTORS®. “REALTORS® have expanded their business model with best practices such as virtual showings and digital signatures and support you with due care.”

Peter Squire is WinnipegREALTORS® Vice-President, External Relations & Market Intelligence.