By Peter Squire

Manitobans pay very high taxes. Some of the highest in the country.

Fortunately, we received some tax relief with the reduction of the provincial sales tax (PST) from 8 to 7 per cent on July 1. We have also heard that if the current provincial government is re-elected this fall, they plan to provide PST relief on home insurance by not applying the 7 per cent tax on our home insurance bill. A key thrust of these measures, which help homeowners, is to keep more money in Manitoban’s pockets so they are in a better position to afford to buy and own a home.

We may hear more tax relief proposals when the provincial election campaign kicks off later

this month. However, the one relief measure WinnipegREALTORS® really wants to see the Tory-led provincial government and opposition parties put forward during this provincial election is land transfer tax (LTT) relief. An overhaul of this tax is long overdue and will make a difference in helping millennials and newcomers to Manitoba attain home ownership.

It has been reported millennials make up the largest voting bloc this election cycle. To this end, the Canadian Real Estate Association (CREA) commissioned Abacus Data last spring to survey millennials on home ownership and their aspirations to become home owners. The widely reported survey of 2,500 millennials across the country showed conclusively that the vast majority of them want to own a home one day with 68 per cent of them passionate about owning a home. As a result, they place housing affordability as a top priority (e.g. 68% in Manitoba) and are concerned about all aspects of the cost of buying a home including taxes and fees.

A number of provincial governments have recognized the financial challenge of buying a first home and have been offering first-time homebuyers LTT exemptions for years. These provinces include B.C., Ontario and Prince Edward Island. In 2018, Quebec brought in a first-time homebuyers’ tax credit which matches the $750 federal government first-time homebuyer tax credit.

If you go to ratehub.ca/land-transfer-tax and scan all of the provinces to determine how they treat land transfer taxes in their jurisdiction — including what they offer in terms of a first-time homebuyer exemption — both Alberta and Saskatchewan are referred to as not having land transfer taxes, but much smaller transfer fees instead. For example, in Manitoba, if you purchase a $300,000 home you will pay $3,720 in land transfer taxes and registration fees, while in Alberta and Saskatchewan you will pay $60 and $899.80 respectively.

Other provinces — such as New Brunswick, which does not have a first-time homebuyer exemption — charge lower land transfer tax rates than Manitoba (i.e. 1% across the board, where Manitoba’s scales up to 2% for any property value above $200,000).

Clearly, Manitoba stands out across the country as one province where land transfer taxes are high and unforgiving. Here, no relief is offered to first-time buyers trying to save up enough down payment to purchase a home, let alone worry about coming up with thousands of extra dollars in closing costs to pay the provincial land transfer tax.

While Manitobans may not know what other provinces levy on purchasing a home, they are aware how it can impact them here. In June 2019, WinnipegREALTORS® teamed up with the Manitoba Real Estate Association (MREA) to ask some questions about the land transfer tax. A survey was conducted by Probe Research from June 4 to 17, with a sample size of 1,000 respondents, and the results show strong support for LTT relief.

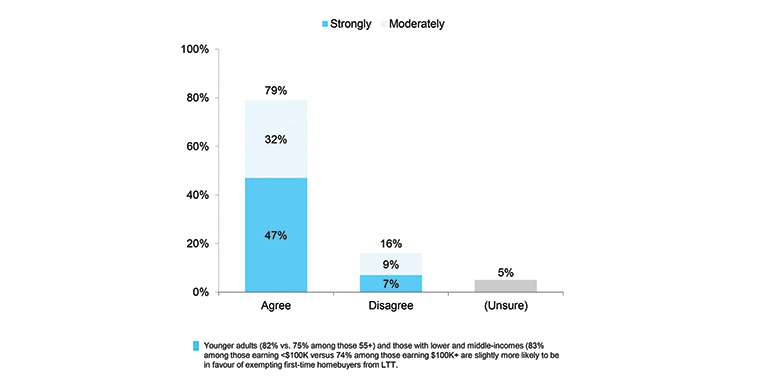

The most favourable response was on thefirst-time homebuyers’ exemption, which Manitoba REALTORS® have been advocating to government over the last few years. No specific proposal in the survey question was put forward, as they vary across the country in terms of how much relief is offered, but a $750 tax credit like Quebec offers is a starting point which MREA has been calling for. As you can see from the chart, 79% of Manitobans either strongly or moderately agree to an LTT first-time homebuyer exemption. It is even higher for millennials.

Two questions proposed ways in which to offer all Manitoba homebuyers some LTT relief, while helping first-time buyers at the same time.

First, the poll results showed 68% of Manitobans either strongly or moderately agreed that the rates at which LTT is charged should be adjusted to reflect current housing prices.

The current LTT rates were introduced in 1987, with 1.5% being the highest tax rate charged at any value above $150,000. In 2004, the provincial government increased the highest tax rate to 2% for any amount over $200,000. Since the higher rate was brought in, house prices have gone up significantly, so many first-time buyers are now subject to this higher rate. It works out to $2,000 in land transfer taxes for every $100,000 of value in excess of $200,000. Rolling back the 2004 rate increase from 2% to 1.5% will save the buyer of a $300,000 home $500.

It should also be noted that the rates at the time the LTT were established in Manitoba were intended to be revenue neutral to fees Manitobans were paying at the time. The government even thought of the impact on first-time buyers by not charging LTT on any amount under $30,000.

Second, the poll results indicated that 69% either strongly or moderately agree that price thresholds at which LTT is charged should be adjusted to reflect current house prices.

The $200,000 threshold level created in 2004 for the new 2% LTT rate is nowhere near what you need to pay now for a home purchased in 2019. In June 2004, only 12% of homes transacted in the Winnipeg Metro Region sold for over $200,000. In June 2019, the percentage of homes selling for over $200,000 was 86% — almost entirely flipped around.

The survey indicated that 10% were unsure, and WinnipegREALTORS® is convinced the support for providing LTT relief would be higher from this group if they were told exactly what has transpired since the LTT was introduced in 1987.

Soon, candidates running in the provincial election will be asking for your support, so now is the perfect time to bring up the LTT and tell them it is high time it was lowered to be harmonized with today’s house prices.

Peter Squire is WinnipegREALTORS® Vice-President, External Relations & Market Intelligence.