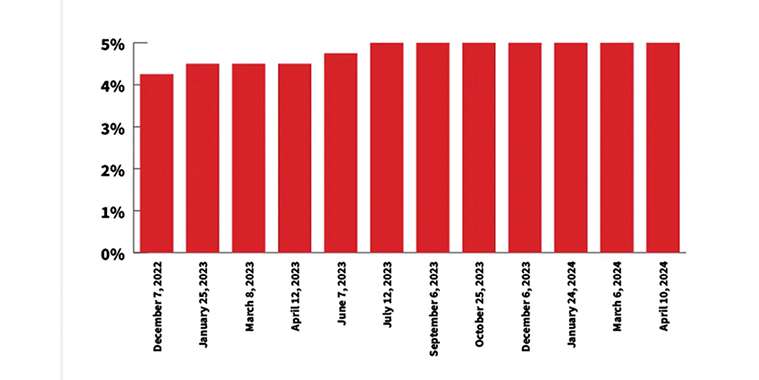

Hey, at least interest rates aren’t rising again! Following the Bank of Canada’s recent decision to keep the overnight policy rate at 5%, many Canadian homeowners, buyers and sellers may be left wondering: well, now what?

With inflation settling down, many Canadians have been under the impression that interest rates will be decreasing soon, too. A report from Royal LePage shows 51% of Canadians who had put their home buying plans on hold over the last two years will return to the market when the first rate cut comes.

That cohort of Canadians will have to wait it out a bit longer as the Bank of Canada will want to see inflation decrease some more before they cut their overnight policy rate.

But, what if you’re in a position where you have to move, like, now? If you previously put your buying plans on hold, chances are your patience is running thin for the Bank of Canada to cut rates. In the meantime, prices could rise, markets could heat up, and then you might get left behind.

This is why finding the right REALTOR® for you is such a crucial step in the homebuying process. Navigating the current real estate landscape is tricky in times of uncertainty, but luckily for you, your REALTOR® can help calm your concerns. Here’s how.

Market insights

Even without a cut in interest rates, it’s important to know you have plenty of options. Your REALTOR® has access to data pertaining to your local housing market and can advise you on how things may shake out in the near future. Is it best to go with a variable rate or a fixed rate? In a competitive market, what conditions should you consider or not? What types of homes are most popular and have had their value rise in your area — detached, townhomes or condos?

For sellers, your REALTOR® can get information on comparable homes and see what they sold for and when, access the exclusive MLS® Home Price Index (HPI) — an advanced, highly accurate way to gauge prices and trends in specific areas — and know what buyers are looking for in your region.

For buyers, your REALTOR® is there to work for you and get the best home for you. They can advise you on what to expect in your local market, from commute times and proximity to amenities, to noise levels and municipal regulations you may have never heard about.

All real estate markets are local — what’s happening with national numbers may not be relevant for you. For example, buying a condo in Toronto is going to be a completely different experience than buying a colonial in Coquitlam or a high-ranch in Halifax. Your REALTOR® will help you make sense of it all.

Negotiation skills

It doesn’t matter if interest rates are at 5%, 10%, or 1% — at the end of the day, your REALTOR®’s top priority should be looking out for you and making sure you’re comfortable with whatever price you land on.

Of course, a buyer’s agent should know what their client is pre-approved for, and interest rates often affect how much home one can afford. Make sure you communicate your wants, needs and budget so your REALTOR® can properly advocate on your behalf. You can look for REALTORS® with a Certified Negotiation Expert designation or a Master Certified Negotiation Expert for those who have received extra training.

Financial guidance

Did you know your REALTOR® can help you before you’re pre-approved? That’s right! While you’re waiting to see what interest rates do, consider reaching out to your REALTOR® to get a handle on how your local market is reacting to the latest news from the Bank of Canada.

Your REALTOR® can also provide you with a list of lenders they’ve worked with, not to mention offer some tips and tricks to help you solidify a better rate (like, make sure you shop around before signing!).

Before doing anything, check out the Calculator Hub under “About Mortgages” at www.winnipegregionalrealestatenews.com — a tool to help provide you with an early look at your financial situation.

Professionalism and sense of security

One of the biggest worries for Canadians on the move is the uncertainty of conducting a real estate transaction. There are so many variables (not just talking about interest rates here!) to think about. From land transfer taxes and lawyer fees, to dealing with complete strangers while trying to complete one of the largest financial transactions of your life — you have a lot on your plate if you’re buying or selling.

Also, the right REALTOR® for you will just get it. They won’t push you into something you’re uncertain about and can even help with market timing strategies should you want to try and make the current interest rate situation work better for you.

Home buying and selling MVP

We’ll say it again: your REALTOR® is your personal real estate MVP. While you’re figuring out financing, they can already get to work behind the scenes. If you’re buying, this means setting up searches for you, attending open houses on your behalf, and asking around to their connections about what might be coming available — hey, if you’re in no hurry and want to wait for interest rates to drop, maybe this is a strategy for you!

If you’re selling, your REALTOR® can get to work marketing your property, getting it ready for staging and compiling documentation, all without disrupting your routines too much.

By now you know interest rates impact the Canadian real estate landscape and that likely isn’t about to change any time soon. Making the right decision at the right moment seems like a lot of pressure when you don’t know where interest rates will be on a month-to-month basis. Thankfully, REALTORS® monitor market trends and housing data to make sure, whether you’re buying or selling, your best interests are being kept top of mind. Don’t put it off any longer! Visit www. winnipegregionalrealestatenews.com or scan the QR code below and find your REALTOR® today!

— REALTOR.ca