By Peter Squire

The Winnipeg Regional Real Estate Board (WRREB) 2021 Market Insights event was held on February 3 with over 400 WRREB Members and stakeholders in attendance. Sponsored by CIBC Financial (Title Sponsor), One Link Mortgage and Financial (Kick-Off Sponsor) and Palmina Thomson, Home Finance advisor for Scotiabank (program sponsor), this event, which is held annually, showcased both the local and national real estate markets.

WRREB CEO Marina R. James kicked off this year’s event by welcoming those in attendance and speaking about the rebranding of WRREB in January 2021 from WinnipegREALTORS® to the Winnipeg Regional Real Estate Board. This new name now reflects the rural area that is part of WRREB’s expanded market region.

The rural region emerged as a strong area of growth in driving increased MLS® sales in 2020. The rural market region saw its total MLS® market share increase by 6% — from 30% to 36%. When you have the vacant land property type — where the majority of sales were located outside Winnipeg — increase 72% to 862 sales, it is readily apparent that rural MLS® areas were extremely active.

WRREB president for 2021, Kourosh Doustshenas, also addressed attendees and emphasized how important the real estate industry sector as a whole is in its contribution to the economy. For every sale, there is $53,000 in economic spin-offs.

Don White, CEO and Co-founder of a local private equity firm called Private Pension Partners — and a former WRREB Commercial Division Chair — kicked off the main Market Insights presentations. White indicated that different commercial sector performances have been unbalanced and not equal. Some sectors, such as industrial and apartments, are excelling with new development while office and retail downtown and elsewhere are suffering due to many employees working from home because of the pandemic.

“There are mounting vacancy pressures and there will be opportunistic leasing opportunities in these sectors,” he said.

White went on to say retail is really divided as to whether it is open air or enclosed. Enclosed malls have been hit hard while shopping centres anchored by a Home Depot or a Walmart are succeeding. Fast service entities such as take-out restaurants and cannabis retail outlets are also thriving. Retail is also seeing a refresh of grocery with the conversion of Safeway and Sobeys stores to FreshCo.

Looking further ahead when it is once again safe to work in downtown offices, White expressed strong optimism for a rebound in downtown commercial activity as the downtown is “a place of congregating, a place of business, a place of idea exchange and of efficiency”. He added that with the amount of money and capital being invested in our downtown in the next five years it will be very different in a positive way than it is today.

White is confident Winnipeg will come back strong from the pandemic given its resiliency, developed in part through its isolation from other major cities and diversity in the make-up of its economy.

In wrapping up his presentation on future development, White said we are more in an under-demolished state as opposed to overbuilt. He actually sees in all sectors a move to sell and dispose of older properties in 2021. These properties will still have a place in our market but will need “reinvestment, repositioning and reenergization”. Things remain fundamentally in balance with the exception of office. Retail vacancy rates are from 5-6%, industrial at under 4% and apartment vacancy remaining below 4%.

The two other presenters, myself and CREA’s senior economist Shaun Cathcart, had similar sentiments. We both spoke of homebuyer intentions, preferences changing due to Covid-19 and the historic low mortgage rates propelling sales to record levels both locally and nationally.

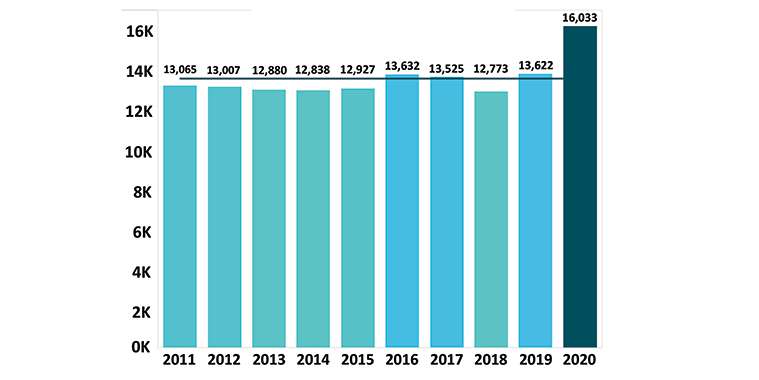

The main difference between the local and national markets were the number of national MLS® sales (550,000 in 2020) beat the 2016 record by 2% whereas in the WRREB market region the 16,033 sales shattered the 2019 record by 17%. It was observed that Winnipeg and Manitoba’s relatively affordable house prices in relation to more expensive housing markets across the country played a contributing factor. Manitoba, Quebec, New Brunswick and Nova Scotia were the only provinces to set sales records in 2020.

As a result of the record MLS® sales activity, tight listing supply conditions prevailed into the second half of 2020 and continue today. Demand overwhelmed the available listing supply and national house prices soared. WRREB’s balanced housing market was more constrained initially in price increases until listings became depleted later in 2020, and then single-family house prices were seeing year-over-year increases in the double digits. The conversions of sales to listings was very high and created sellers’ market conditions with more listings generating multiple offers and above list sale prices.

To understand in detail why both myself and Cathcart are bullish on brisk sales continuing in 2021, and why increased listings will be necessary to address the imbalances created in 2020, visit the WRREB’s YouTube channel at “Winnipeg Regional Real Estate Board” to watch our presentations, along with Don White’s presentation, from Market Insights 2021.

Peter Squire is the Winnipeg Regional Real Estate Board’s Vice-President, External Relations & Market Intelligence.