By Peter Squire

We are living in extraordinary times, and homebuying trends are evidence of that.

At the beginning of June, WinnipegREALTORS® teamed up with the Manitoba Real Estate Association (MREA) to conduct a buyer sentiment survey to gauge how home buyers felt about moving forward to purchase a home. The results showed the vast majority of Manitobans were undeterred by the pandemic and would not put their plans on hold to purchase a home or property such as a vacant lot. 84% of Manitobans said Covid-19 would have no impact on them at all while another 4% actually said it would motivate them to advance their plans to buy a home.

Little did we know back then that this positive sentiment for home ownership and property acquisition would continue well beyond what you would expect to be a recovery period following the economic shutdown in late March/April. In April, MLS® results showed single-family homes sales down 32 % and condominiums plummeting 54% compared to April 2019. But by the end of May, there were already signs that buyers were returning to what normally is our busiest month of the year. Sales started to recover but were still off the previous May by 18% in single-family and 41% in condos.

June marked the true start of a full recovery with overall MLS® sales up 24% to close to 1,900 sales — far ahead of the previous best month sales performance ever in May 2019 of 1,705 sales. Condominiums, which had suffered greater decreases than single-family homes, also saw a good comeback with a 13% increase and nearly 200 sales in June.

Fast forward to today and the pace hasn’t let up, with consecutive record-breaking months and year-to-date MLS® sales as of mid-month well in excess of making up for the start of the year’s deficit. Year-to-date sales are ahead of 2019 by 15% — 14,465 versus 12,546. As a result, WinnipegREALTORS® has already set an annual record for total sales as formerly its best year ever was in 2019 at 13,662 sales.

While it is patently clear that historically low discounted mortgage rates at well below 2% are enabling and helping drive this amazing run of sales activity, what is not known as well is the extent of the pandemic’s impact on motivating purchasers to buy at this time.

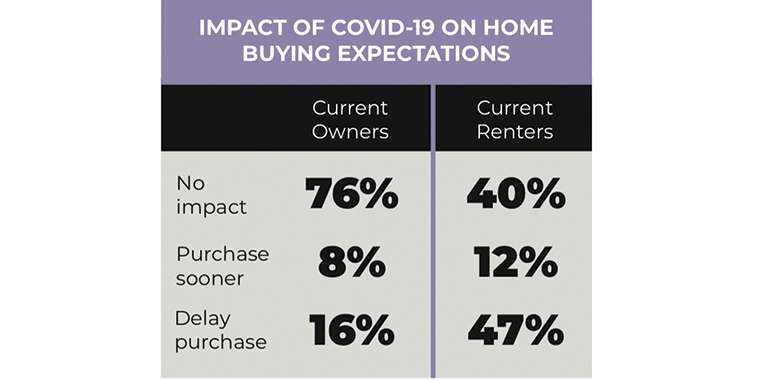

Mortgage Professional Canada’s Chief Economist, Will Dunning, attempts to answer this question in his most recent national consumer survey (September 23 to October 8) of owners with mortgages, renters, and a small sample size of a younger demographic living at home. It is titled Rapidly Evolving Expectations in the Housing Market and is the third in a series of four being conducted this year.

An indicator of Covid-19 being more of a factor in a buyer’s decision-making than previously believed is survey respondents choosing response 3 — My current home is no longer suitable (i.e. size, location) — by a decided margin over the other six responses offered. The second preferred choice by owners was the renters’ number one choice, response 2 — I want to live in a nicer home. A total of 25% of renters chose this one while another 20% chose the owners’ first choice of their premises being no longer suitable.

The percentage of owners choosing response 3 was 38% while another 13% chose response 2. And not surprisingly, those respondents still living at home stated their strongest preference was the one that said low interest rates make this a good time to buy.

As Dunning deduced in his report, “For many Canadians, the pandemic has raised interest in making housing changes, to make it easier to social distance, or to find housing that is more suitable in a work-

at-home/spend-more-time-at home world”. He also makes the statement, which is borne out by the breakdown in price range sales activity in our local market this year, that “for people in reasonably stable economic situations who expect that stability to continue, there is currently heightened interest in home buying”. This is more evidence that for those that can, they will act if necessary.

Evidence of stable buyers are the ones who are able to afford to buy homes in the $500,000 to $750,000 price range. In more recent months, including

October, sales in this price range have been well above the norm and contrast sharply from first-time buyer price ranges that have seen far more modest increases over last year. In October there were 126 single-family homes bought in the $500,000 to $750,000 price range — compared to 63 in the same month last year — while in the popular first-time buyer price range of $250,000 to $299,999, sales of 189 this year were only 5 greater than October 2019.

Canadian Real Estate Association’s (CREA) senior economist, Shaun Cathcart, echoes a similar assessment in the October national market release when he said, “Many reasons have been suggested for why this is when many traditional drivers of the market — economic growth, employment and confidence in particular — are currently so weak. Something worth considering is how many households are choosing to pull up stakes and move as a result of Covid-19 and all the associated changes to our lives. We could be seeing a lot of moves, or churn in the market, that would not have happened in a non-Covid world.”

As one of folk singer Bob Dylan’s most widely known song titles says, “The Times They are A-Changin’”.

Peter Squire is WinnipegREALTORS® Vice-President, External Relations & Market Intelligence.